AI investing apps are revolutionizing the wealth management landscape, democratizing access to intelligent investing tools for both novice investors and seasoned financial institutions. By harnessing the power of artificial intelligence (AI), machine learning (ML), and big data analytics, these apps analyze vast datasets in real time, enabling data-driven decisions with unparalleled precision.

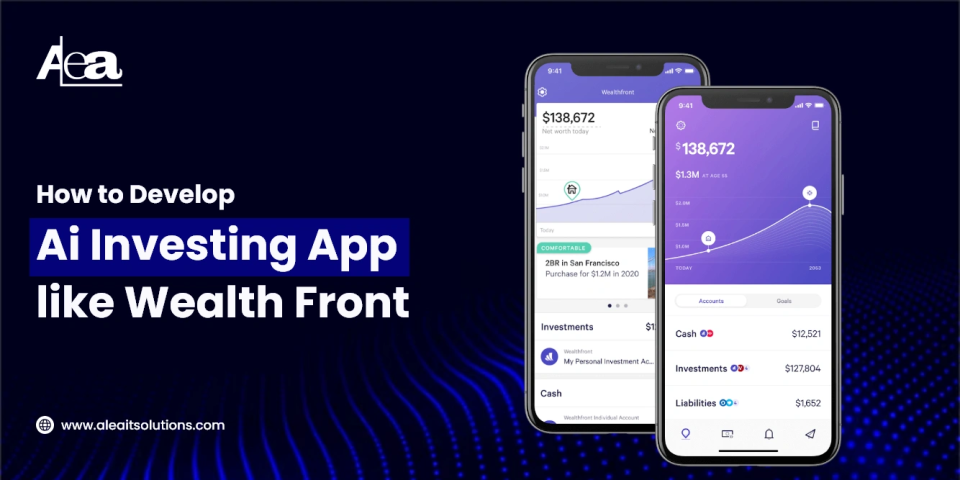

Unlike traditional methods, AI-powered apps like Wealthfront leverage sophisticated algorithms to automate processes such as portfolio diversification, rebalancing, tax optimization, and retirement planning. These systems continuously adapt to market fluctuations, personal financial goals, and individual risk profiles, removing the complexity of manual stock picking.

The true value of AI investing apps lies in their ability to provide personalized, adaptive investment strategies tailored to each user’s unique financial objectives. Whether users are saving for college, planning for retirement, or seeking to grow wealth, AI evaluates key factors—like income, spending behavior, risk tolerance, and market trends—to craft customized financial strategies.

With AI investing, users can effortlessly automate wealth-building and investment management, while gaining actionable insights into their portfolios, thus boosting confidence and enabling smarter, long-term financial decisions.

AI Investing App Market Stats (2025–2030)

The AI-driven fintech sector is gaining significant momentum, with investing apps at the heart of this transformation. According to Grand View Research, the global AI in fintech market is expected to surpass $61.3 billion by 2030, growing at a robust 22% CAGR. This rapid expansion is driven by a surge in demand for intelligent financial tools and the rise of retail investors seeking automated, data-driven solutions.

By 2025, robo-advisory platforms like Wealthfront and Betterment are projected to manage over $2.5 trillion in assets globally. AI platforms are set to power 35% of all digital investments by 2025, underlining the increasing comfort with algorithm-driven wealth management.

With millennials and Gen Z driving the adoption of these platforms, and traditional institutions embracing AI, investing apps are positioned to dominate the wealth management space in the coming years. The growing trend is further evidenced by mobile market statistics, which indicate a sharp rise in AI-powered investing apps, making them a key player in the future of finance.

Read Also: AI development companies in USA

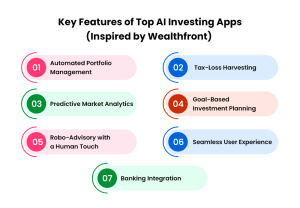

Key Features of Top AI Investing Apps (Inspired by Wealthfront)

When building an AI investing app, it’s essential to incorporate features that not only attract users but also deliver long-term value.

Wealthfront is a great example to draw inspiration from, as it combines automation, personalization, and simplicity in one powerful platform. Below are the must-have features for any top-performing AI investing app

1. Automated Portfolio Management

One of the biggest strengths of Wealthfront is its ability to rebalance portfolios automatically. Instead of requiring users to manually adjust their asset allocation, the app ensures portfolios remain diversified and aligned with risk tolerance.

This feature uses AI to monitor market movements and rebalance investments at the right time, ensuring steady performance with minimal effort from the user.

2. Tax-Loss Harvesting

Smart tax management is a game-changer in investing. Wealthfront’s AI-driven tax-loss harvesting helps users reduce taxable gains by selling underperforming assets and replacing them with similar, yet more profitable, alternatives.

For investors, this means better after-tax returns without having to understand complex tax codes.

3. Predictive Market Analytics

AI investing apps go beyond traditional financial advice by using big data and machine learning models to forecast trends.

Predictive analytics gives users valuable insights into market conditions, helping them make informed investment decisions. From stock behavior to macroeconomic shifts, this feature keeps investors a step ahead.

4. Goal-Based Investment Planning

Not all investors have the same objectives. Whether someone is saving for retirement, a child’s education, or short-term goals like buying a home, AI apps personalize strategies accordingly.

Wealthfront, for instance, allows users to define goals and then uses algorithms to create customized investment paths.

5. Robo-Advisory with a Human Touch

While AI does most of the heavy lifting, users still value human expertise. Apps like Wealthfront combine AI-powered robo-advisory with access to financial experts, offering the perfect blend of automation and reassurance. This hybrid model builds trust and improves adoption rates.

6. Seamless User Experience

A complicated app can push investors away. Wealthfront has mastered the art of delivering a clean, intuitive interface where users can track portfolios, manage goals, and access insights with ease. A top AI investing app should focus on simple navigation, engaging dashboards, and real-time updates.

7. Banking Integration

The future of investing lies in offering all-in-one financial ecosystems. Wealthfront integrates banking features, including checking, savings, and investing, so users can manage their entire financial life in one place.

This not only boosts user retention but also positions the app as a full-scale wealth management solution rather than just an investment tool.

Together, these features make AI investing apps like Wealthfront highly attractive to modern investors. They provide automation for efficiency, personalization for relevance, and simplicity for accessibility, a winning combination for long-term success.

Related Article: How to Develop an AI-powered Interview Platform

Popular AI Investing Apps 2025

While Wealthfront remains one of the most recognized AI investing platforms, the fintech landscape has grown rapidly, with several other apps emerging as strong competitors. Each of these platforms leverages artificial intelligence to simplify investing, provide personalized guidance, and optimize returns for users.

1. Betterment

Betterment is a leading robo-advisor that focuses on goal-based investing and automated portfolio management. Its AI algorithms automatically rebalance portfolios, provide tax optimization through tax-loss harvesting, and offer personalized investment strategies.

Users can set short-term or long-term goals, and Betterment’s AI ensures their investments stay aligned with their objectives, making wealth-building easier and more efficient.

2. Acorns

Acorns takes a slightly different approach by offering micro-investing solutions. It rounds up everyday purchases to the nearest dollar and invests the spare change automatically.

AI helps optimize these micro-investments and manages the portfolio based on individual risk preferences. This approach makes investing accessible for beginners or those who want to invest without actively monitoring the market.

3. Robinhood AI

Robinhood, known for commission-free trading, has introduced AI-powered insights to enhance its platform. Its algorithms analyze market trends, track stock performance, and provide predictive recommendations.

This allows investors to make smarter trading decisions quickly, without needing advanced financial knowledge. Robinhood AI blends simplicity with data-driven decision-making.

4. Zerodha Varsity AI (India)

Zerodha, India’s leading retail trading platform, has integrated AI into its Varsity educational platform and trading tools. It provides personalized stock trading guidance, risk analysis, and real-time market insights.

Retail investors in India can benefit from automated recommendations while learning how the market works, making Zerodha Varsity AI a perfect combination of education and investing.

Why These Apps Stand Out

These AI-driven platforms highlight the power of automation, personalization, and accessibility in modern investing. By reducing the complexity of traditional investing, they allow both beginners and experienced investors to maximize returns with minimal effort.

Features like predictive analytics, automated rebalancing, and goal-based planning ensure users can invest smarter and stay confident, even in volatile markets.

Why Now Is the Perfect Time to Invest in Developing an AI Investing App

The fintech industry is evolving rapidly, and AI-powered investing apps are at the forefront of this transformation. Retail investors are moving away from traditional financial advisors, seeking smarter, automated solutions that offer personalized insights, real-time analytics, and seamless portfolio management.

Between 2025 and 2030, the AI investment space offers a prime opportunity for startups and established companies to innovate. With regulators increasingly supporting AI in fintech, compliance risks are lowering, creating a safer environment for growth.

Generative AI and machine learning are revolutionizing how apps analyze market trends, predict risks, and optimize returns—bringing tools once reserved for institutional investors to the hands of retail users.

For fintech entrepreneurs, this is a chance to create highly personalized, scalable apps that cater to the growing demand for smart, cost-effective investment solutions. Understanding the fintech app development cost is key to building a competitive, future-proof platform that can attract tech-savvy investors and position your business as a leader in the industry.

In short, the combination of rising demand, regulatory support, and AI advancements makes this the ideal time to invest in developing an AI-powered investing app one that could rival platforms like Wealthfront in both functionality and user trust.

Real-World Examples of Companies Using AI in Investing

AI is no longer a futuristic concept in finance it is actively shaping how investments are managed today. Leading artificial intelligence development companies around the world are leveraging artificial intelligence to optimize portfolios, predict market trends, manage risk, and enhance customer experience. Here are some notable examples:

1. Wealthfront

Wealthfront is a fully automated robo-advisor that uses AI to handle portfolio management, tax-loss harvesting, and goal-based investing. Its algorithms continuously analyze market conditions and adjust investments automatically, helping users maximize returns while minimizing risk.

Wealthfront demonstrates how AI can make sophisticated investment strategies accessible to retail investors without requiring advanced financial knowledge.

2. BlackRock (Aladdin)

BlackRock’s Aladdin platform employs AI to conduct global risk assessments and support portfolio management for institutional investors.

By analyzing vast datasets, including macroeconomic trends and market behavior, Aladdin helps investors make informed decisions and identify potential risks before they become critical. This shows how AI can enhance decision-making at scale in the financial sector.

3. JP Morgan

JP Morgan utilizes AI for fraud detection, portfolio analysis, and predictive analytics. Its AI-driven tools help monitor transactions in real time, identify suspicious activity, and provide investment insights based on market patterns.

By reducing human error and speeding up analysis, JP Morgan ensures that clients receive efficient and secure financial services.

4. Charles Schwab

Charles Schwab has integrated AI into its investment platform to offer intelligent portfolio solutions. From risk profiling to automated recommendations, the platform uses AI to guide investors in building portfolios aligned with their financial goals.

Schwab’s approach highlights the growing role of AI in personalized investment management, blending technology with expert oversight.

Trends in AI Investing Apps: Navigating the Future of Finance

The AI investing space is evolving at a rapid pace, and staying ahead of the latest mobile app development trends is crucial for fintech startups and entrepreneurs looking to build cutting-edge platforms like Wealthfront. These trends are not only reshaping traditional investment strategies but also enhancing user experiences and boosting security features.

From the rise of predictive analytics to the integration of real-time data processing, AI investing apps are leveraging innovative technologies to provide smarter, more personalized investment strategies.

As demand for AI-powered solutions grows, staying informed on these trends is key to creating an app that meets the needs of modern investors while maintaining a competitive edge in the rapidly changing fintech market.

1. Generative AI for Forecasting

Generative AI is transforming investment forecasting by creating more accurate market simulations. By analyzing historical data, market trends, and macroeconomic indicators, generative AI can simulate multiple market scenarios and predict potential investment outcomes.

This enables investors to make proactive, data-driven decisions, rather than reacting to market volatility after the fact.

2. Hyper-Personalization

Modern investors expect platforms to understand their unique financial goals, risk appetite, and preferences. AI investing apps now offer hyper-personalized portfolios that adjust automatically based on user behavior and life events.

From retirement planning to short-term savings goals, hyper-personalization ensures that each investment strategy is tailored to the individual, increasing engagement and satisfaction.

3. AI-Blockchain Synergy

Integrating AI with blockchain technology enhances transaction transparency, security, and efficiency. Blockchain ensures that every trade and investment record is immutable, while AI can analyze blockchain data in real time to detect anomalies or optimize trades.

This combination offers a highly secure and trustworthy investment ecosystem for both retail and institutional investors.

4. Voice-Driven Investments

Voice-activated AI assistants are becoming a convenient way to manage investments hands-free. Investors can check portfolio performance, execute trades, or receive AI-driven recommendations simply by speaking to the app.

This trend not only improves accessibility but also makes investing faster and more interactive, appealing especially to tech-savvy millennials and Gen Z users.

5. RegTech Integration

Compliance is a critical concern in fintech. AI-powered RegTech solutions automate monitoring of regulatory changes, ensuring investment platforms remain compliant with local and international laws.

Automated compliance reduces human error, speeds up audits, and minimizes the risk of regulatory penalties, making it an essential feature for any modern AI investing app.

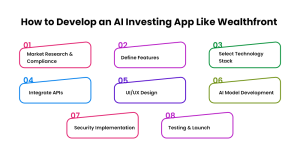

How to Develop an AI Investing App Like Wealthfront

Creating an AI-powered investing app like Wealthfront involves strategic planning, cutting-edge technology, and strict regulatory compliance. For fintech entrepreneurs and startups aiming to develop a smart, secure, and user-friendly platform, partnering with expert mobile app developers is crucial.

By leveraging AI in mobile app development, you can build a platform that delivers personalized, data-driven investment strategies to users. Here’s a step-by-step guide to help you create an AI-powered investing app that stands out in a competitive market:

1. Market Research & Compliance

Before development, it’s essential to analyze the market and understand your target users. Identify gaps in current offerings, user pain points, and emerging trends.

Simultaneously, ensure your app meets regulatory requirements from authorities like the SEC (US), RBI (India), and GDPR (EU). Compliance is critical to avoid legal penalties and build investor trust.

2. Define Features

Determine the core features your AI investing app will offer. Must-have functionalities include:

- Robo-advisors for automated portfolio management

- Predictive analytics for market insights

- Goal-based planning for retirement, education, or savings

- Banking integration to unify checking, savings, and investing

By clearly defining features upfront, you can align development with user expectations and business objectives.

3. Select Technology Stack

Choosing the right technology stack is crucial for building a scalable and efficient platform. Popular choices include:

- AI/ML frameworks: TensorFlow, PyTorch, Scikit-learn

- Cloud platforms: AWS, Google Cloud Platform (GCP), Azure

- Backend frameworks: Node.js, Django, or Spring Boot

- Databases: PostgreSQL, MongoDB, or Firebase

The technology stack should support real-time analytics, secure transactions, and scalability as your user base grows.

4. Integrate APIs

APIs are essential for real-time functionality. Your app will need:

- Stock exchange APIs for live market data

- Payment gateway APIs for seamless transactions

- Banking APIs for account integration

- Data aggregation APIs for financial news and analytics

API integration ensures that your app delivers accurate, up-to-date, and actionable insights to users.

5. UI/UX Design

A clean and intuitive interface is critical for adoption. Wealthfront excels with user-friendly dashboards, simple navigation, and goal tracking features.

Focus on designing screens that allow users to view portfolio performance, set goals, and act on AI recommendations effortlessly.

6. AI Model Development

The heart of your app is its AI engine. Train machine learning algorithms to:

- Profile users’ risk tolerance

- Forecast market trends and asset performance

- Optimize portfolios and tax strategies

- Provide personalized investment recommendations

Continuous AI model training ensures that the app learns from new data and improves decision-making over time

7. Security Implementation

Financial apps require top-notch security. Implement measures like:

- End-to-end encryption for data transmission

- Multi-factor authentication for account protection

- Fraud detection algorithms to monitor suspicious activity

- Regular security audits to identify and fix vulnerabilities

Security builds user trust and protects sensitive financial information.

8. Testing & Launch

Before going live, conduct comprehensive testing:

- Functional testing for all features

- Load testing to handle high traffic

- Security testing for vulnerabilities

- Compliance testing to meet regulatory standards

After successful testing, launch your app and monitor performance continuously. Post-launch updates and AI model improvements are essential to remain competitive.

Cost of Developing an AI Investment App

Developing an AI-powered investing app like Wealthfront involves multiple components, from designing the user interface to building complex machine learning algorithms.

The overall app development cost can vary widely depending on features, complexity, team location, and technology choices. On average, the investment ranges from $80,000 to $250,000, broken down as follows:

| Development Stage | Cost Range | Development Languages & Technologies |

| 1. Research & Planning | $5,000–$15,000 | – Market research tools- Project management tools (e.g., Jira, Trello) |

| 2. UI/UX Design | $10,000–$30,000 | – Figma- Sketch- Adobe XD |

| 3. Front-End Development | $20,000–$50,000 | – HTML, CSS, JavaScript- React.js, Vue.js, Angular.js |

| 4. Back-End Development | $30,000–$70,000 | – Node.js, Python, Ruby on Rails- SQL, PostgreSQL, MongoDB |

| 5. AI Model Development | $40,000–$100,000+ | – Python (TensorFlow, Keras, PyTorch)- R, Scala, Java |

| 6. Testing & Quality Assurance | $10,000–$30,000 | – Selenium- Jest- Mocha, Chai (for unit testing) |

Total Estimated Cost:

-

Basic App: $50,000–$80,000

-

Mid-Range App: $100,000–$150,000

-

Enterprise-Grade Platform: $150,000–$250,000+

Variable Factors Affecting the Development Cost of an AI Investment App

The cost of building an AI investing app like Wealthfront is not fixed—it depends on several key factors that influence both development time and resource requirements. Understanding these variables can help startups and fintech companies plan their budgets more effectively.

1. Feature Complexity

The more features your app has, the higher the development cost. Advanced functionalities such as automated portfolio rebalancing, predictive analytics, tax-loss harvesting, goal-based planning, and banking integration require sophisticated AI algorithms and additional backend infrastructure.

Even seemingly simple UI features, like interactive dashboards and personalized alerts, add to the overall cost.

2. AI Training Data

AI models rely on large datasets to make accurate predictions and personalized recommendations. The volume and quality of data directly impact computing requirements and training time.

Handling complex financial data, historical market trends, and user behavior data requires powerful servers, cloud storage, and specialized ML engineers, which increases development expenses.

3. Security & Compliance

Financial apps must comply with strict regulatory standards like the SEC in the US, RBI in India, and GDPR in Europe. Implementing robust security measures end-to-end encryption, multi-factor authentication, fraud detection systems, and regular audits, adds development time and cost.

Compliance is non-negotiable, as lapses can lead to legal penalties and damage user trust.

4. Team Expertise & Location

The cost of hiring a development team varies depending on expertise and geographic location:

- US or Europe-based teams: $100–$150 per hour

- Offshore teams (Asia, Eastern Europe): $40–$80 per hour

Highly skilled AI engineers, fintech developers, and UI/UX designers may charge more, but their expertise ensures the app is scalable, secure, and feature-rich.

Additional Considerations

Other factors can also affect costs, including:

- Maintenance and updates for AI models

- Integration with third-party APIs for market data and banking services

- Cloud hosting and infrastructure for high-speed, real-time operations

By carefully evaluating these variables, businesses can optimize costs without compromising quality, ensuring that the app is both competitive and sustainable in the fast-growing AI investment market.

Read Also: Generative AI in eCommerce

Build an AI Investment Platform With Alea IT Solutions

If you’ve been inspired by the success of platforms like Wealthfront, now is the perfect time to bring your own AI-powered investing app to life.

Alea IT Solutions, a top mobile development company, specializes in building intelligent AI-powered applications for startups and enterprises, delivering secure, scalable, and next-generation fintech platforms.

With deep expertise in artificial intelligence, machine learning, blockchain, and fintech development, Alea IT Solutions provides end-to-end solutions for building a robust AI investment platform. Our services cover every stage of development:

- Idea Validation & Market Research – We help identify market gaps, target users, and define the features that will make your app stand out.

- UI/UX Design – Our design team creates intuitive, user-friendly interfaces that make investing simple and engaging for users of all experience levels.

- AI & ML Model Development – We develop predictive algorithms, risk assessment tools, and personalized investment strategies that continuously learn and adapt to market trends.

- Security & Compliance – Ensuring your app meets global regulatory standards and implementing end-to-end encryption, multi-factor authentication, and fraud detection.

- API & Banking Integration – Seamless connections with stock exchanges, payment gateways, and financial institutions for a complete investment ecosystem.

- Testing, Deployment & Maintenance – We conduct rigorous testing for performance, scalability, and compliance, followed by ongoing support and AI model updates.

Partnering with Alea IT Solutions ensures that your Wealthfront-inspired AI investing app is not just functional, but also future-ready, secure, and optimized for growth. Our AI app development services provide a holistic approach that enables fintech entrepreneurs to enter the market confidently, offering users personalized, automated, and intelligent investment solutions.

Conclusion

The rise of AI-powered investing apps has redefined how individuals and businesses grow their wealth. Wealthfront stands as a benchmark in this space, showcasing how advanced algorithms, automation, and user-friendly design can simplify investing while maximizing returns.

As the fintech industry continues to evolve, partnering with a skilled AI app development company to build an AI investing app like Wealthfront offers entrepreneurs a golden opportunity to tap into a fast-growing market.

Whether you’re a startup aiming to enter the fintech arena or an established financial institution looking to innovate, now is the time to invest in developing a smart, secure, and scalable AI investing platform.

With the right blend of technology, compliance, and user-centric design, you can build the next disruptive fintech solution. Partnering with experts like Alea IT Solutions ensures your app is built with cutting-edge AI models, robust security, and seamless integration, helping you stay ahead in the competitive world of digital investing.

FAQs

1. What is an AI investing app?

An AI investing app uses artificial intelligence and machine learning algorithms to automate investment decisions, manage portfolios, forecast market trends, and provide personalized financial insights.

2. How does Wealthfront use AI in investing?

Wealthfront leverages AI to automate portfolio rebalancing, tax-loss harvesting, goal-based investing, and cash management. Its algorithms adapt to user risk profiles and market shifts, offering personalized wealth management.

3. How much does it cost to build an app like Wealthfront?

The cost of developing an AI investing app like Wealthfront typically ranges from $80,000 to $250,000, depending on the complexity, features, compliance requirements, and development team location.

4. What features should an AI investing app include?

Key features include robo-advisory services, predictive analytics, tax optimization, automated trading, goal-based planning, secure transactions, and a seamless user interface.

5. Is it safe to invest using AI apps?

Yes, when developed with proper security and compliance measures. Leading apps like Wealthfront use end-to-end encryption, secure cloud infrastructure, and regulatory compliance to ensure safety.

6. Why is now the right time to build an AI investing app?

With growing adoption of robo-advisors, rising interest in digital investing, and advancements in generative AI, 2025–2030 represents a prime opportunity for launching AI-driven investment platforms.

7. How can Alea IT Solutions help in building an AI investing app?

Alea IT Solutions specializes in AI, fintech, and blockchain development, providing end-to-end services from strategy and design to deployment and maintenance, helping businesses create scalable and regulation-compliant investment apps.