The billing app development market is experiencing remarkable growth, evolving from simple invoicing tools into powerful financial management platforms that shape the future of businesses.

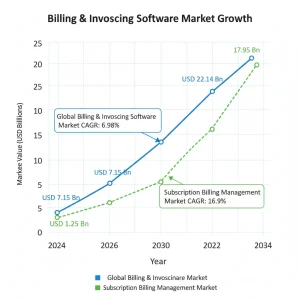

The global billing software market, valued at over $11 billion in 2024, is projected to expand rapidly as more organizations adopt e-invoicing, automated billing systems, and AI-powered financial solutions.

Building an invoice app like Zoho Invoice is no longer just about digitizing payments it’s about creating a smarter, more reliable backbone for modern business operations.

Companies of all sizes are recognizing that the future of billing software lies in automation, predictive analytics, and seamless integration with payment gateways and accounting systems.

From freelancers and startups to enterprises managing global transactions, the demand for billing apps that can handle recurring invoices, tax compliance, multi-currency payments, and real-time financial insights has never been higher.

The true benefits of billing apps extend far beyond efficiency. They reduce manual errors, accelerate cash flow, improve customer trust, and provide business owners with data-driven insights for smarter decision-making.

In short, investing in billing app development is about building the financial foundation that ensures resilience and growth in the years ahead.

What is Billing Application

A billing application is a software solution designed to automate and simplify the process of creating, sending, and managing invoices while keeping track of payments and financial records.

Unlike manual billing methods, which are time-consuming and prone to errors, a billing app provides businesses with a centralized system to handle everything from invoice generation and recurring payments to tax compliance and real-time reporting.

Many companies now rely on professional app development services to build billing apps that are secure, scalable, and customized to their unique needs.

Think of it as a digital assistant for your finances—it not only creates professional invoices but also integrates with payment gateways, accounting tools, and customer databases to ensure every transaction is seamless.

Whether you are a freelancer handling a few clients or an enterprise managing thousands of invoices monthly, a billing application helps you save time, reduce paperwork, and improve accuracy.

Modern billing apps go beyond basic invoicing. They include features like multi-currency support, automated reminders for overdue payments, subscription billing, expense tracking, and AI-driven financial insights.

With businesses increasingly shifting to subscription-based and digital-first models, billing applications built through custom app development services have become essential tools for ensuring faster cash flow, better customer relationships, and long-term financial stability.

Traditional Billing vs. Billing Application

| Aspect | Traditional Billing | Billing Application |

| Process | Manual entry of invoices, paper records, spreadsheets. | Automated invoice creation, digital records, centralized dashboard. |

| Time Efficiency | Time-consuming and repetitive tasks. | Saves time with automation and recurring billing features. |

| Accuracy | High risk of human errors and miscalculations. | Reduces errors with built-in tax rules, templates, and validations. |

| Payment Tracking | Difficult to monitor outstanding and overdue payments. | Real-time payment tracking with reminders and alerts. |

| Scalability | Hard to manage as business grows. | Easily handles thousands of invoices and multi-currency transactions. |

| Customer Experience | Delayed or inconsistent invoices, limited professionalism. | Branded, professional invoices with instant delivery and payment links. |

| Compliance | Manual updates to tax laws and regulations. | Auto-updates for tax compliance, supports e-invoicing standards. |

| Data Insights | Limited visibility into revenue and expenses. | Analytics and reports for smarter financial decision-making. |

Why to Develop Billing Application

Developing a billing application is no longer just a digital upgrade it has become a business necessity in a world where speed, accuracy, and compliance drive success.

The global billing software market is expected to surpass $20 billion by 2030, fueled by the rapid adoption of digital payments, subscription models, and e-invoicing regulations across industries.

Businesses that once relied on spreadsheets or manual invoicing are now realizing that traditional methods not only slow down operations but also expose them to costly errors, late payments, and compliance risks.

A custom billing app empowers organizations to automate repetitive financial tasks, streamline cash flow, and deliver a seamless customer experience.

Features like automated recurring invoices, multi-currency support, instant payment gateways, and AI-powered reporting make billing applications more than just tools they become financial engines for growth.

For small businesses, it means saving valuable hours every week and building professionalism with branded invoices. For enterprises, it means handling thousands of transactions across geographies without compromising accuracy or compliance.

The future of billing is intelligent and connected. With AI predicting payment delays, blockchain ensuring transaction security, and governments mandating e-invoicing for tax transparency, businesses that adopt billing apps early gain a competitive edge.

Developing one is not just about keeping up with digital transformation; it’s about future-proofing your financial operations, strengthening customer trust, and positioning your business to scale in an increasingly global and digital-first economy.

Read Also: Mobile App Statistics & Trends

Steps to Develop Billing Application

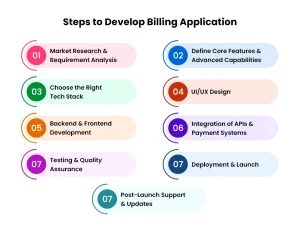

Building a billing application that can compete with solutions like Zoho Invoice requires a thoughtful approach that balances user needs, technical architecture, and long-term scalability. Below are the key steps in the billing app development process:

Step 1- Market Research & Requirement Analysis

Start by analyzing current billing software market trends, user pain points, and competitor offerings. Identify what features businesses value most such as recurring billing, tax compliance, or AI-powered reporting and map them to your target audience (freelancers, SMEs, or enterprises).

Step 2- Define Core Features & Advanced Capabilities

Outline essential features like invoice creation, payment gateway integration, tax management, and analytics. Consider adding advanced features such as subscription billing, multi-currency support, blockchain-based security, and AI-driven forecasting to differentiate your app.

Step 3- Choose the Right Tech Stack

Select technologies that support scalability and performance. Popular choices include:

- Frontend: React, Flutter, or Angular for responsive interfaces.

- Backend: Node.js, Django, Laravel, or .NET for robust APIs.

- Database: MySQL, PostgreSQL, or MongoDB.

- Cloud & Hosting: AWS, Azure, or Google Cloud.

- Payment Gateways: Stripe, Razorpay, PayPal.

Step 4- UI/UX Design

A billing app must be intuitive and user-friendly. Design a clean dashboard, invoice templates, and easy navigation so users can manage finances without complexity.

Step 5- Backend & Frontend Development

Build a secure backend to handle invoice data, payment processing, and user authentication. Simultaneously, develop the frontend with responsive layouts for both web and mobile platforms.

Step 6- Integration of APIs & Payment Systems

Seamlessly integrate payment gateways, tax APIs, and accounting software. Ensure compliance with PCI DSS standards for secure transactions.

Step 7- Testing & Quality Assurance

Conduct rigorous testing for functionality, performance, security, and compliance. Simulate real-world use cases like overdue payment reminders, cross-border transactions, and recurring billing cycles.

Step 8- Deployment & Launch

Deploy the application to a cloud server with CI/CD pipelines, ensuring scalability and uptime. Offer a beta release to collect user feedback before a full-scale launch.

Step 9- Post-Launch Support & Updates

Billing apps need continuous improvement. Regularly update features, address security vulnerabilities, and adapt to new financial regulations and market needs.

Read Also: How Much Does Mobile App Development Cost?

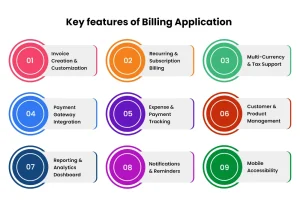

Key features of Billing Application

A billing application is more than just a digital invoicing tool it’s a complete financial assistant that helps businesses streamline transactions, ensure compliance, and strengthen customer trust.

To build an app like Zoho Invoice or compete in the growing billing software market, the following features are essential:

1. Invoice Creation & Customization

Generate professional invoices with company branding, logos, and customizable templates to reflect your business identity.

2. Recurring & Subscription Billing

Automate repeated transactions for subscription-based businesses, reducing manual work and ensuring consistent cash flow.

3. Multi-Currency & Tax Support

Handle global transactions with automatic currency conversion, GST/VAT calculations, and region-specific compliance.

4. Payment Gateway Integration

Connect with secure and popular gateways like Stripe, PayPal, Razorpay, or Square to offer multiple payment options.

5. Expense & Payment Tracking

Track income and expenses in real time, monitor outstanding invoices, and set reminders for due or overdue payments.

6. Customer & Product Management

Maintain a database of clients and services/products to generate invoices quickly without repetitive data entry.

7. Reporting & Analytics Dashboard

Provide businesses with actionable insights, revenue forecasts, and financial health metrics for smarter decision-making.

8. Notifications & Reminders

Send automated email, SMS, or WhatsApp reminders for pending payments, ensuring faster collections.

9. Mobile Accessibility

Cloud-based access with iOS and Android apps, allowing businesses to create invoices and track payments on the go.

10. Security & Compliance

Protect sensitive financial data with end-to-end encryption, two-factor authentication, and PCI DSS compliance for payment security.

11. Integration with Accounting & ERP Systems

Sync invoices and payments directly with accounting software or ERP platforms, eliminating duplicate entries and improving efficiency.

12. AI-Powered Automation (Future-Oriented)

Features like smart invoice categorization, fraud detection, and predictive analytics to forecast late payments and optimize cash flow.

Read Also: Best Mobile App Development Ideas for 2025

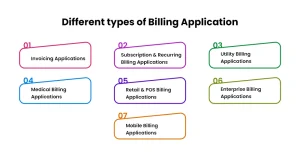

Different Types of Billing Application

The evolution of billing software has given rise to different types of billing applications, each catering to specific industries, business models, and customer needs. Whether you’re a freelancer, a retail store owner, or a large-scale enterprise, there’s a billing solution designed to simplify your financial operations. Below are the most prominent types:

1. Invoicing Applications

These are the most widely used billing apps, perfect for freelancers, consultants, and small businesses. They focus on generating professional invoices, tracking payments, and sending automated reminders. Many invoicing apps also allow businesses to customize branding, making them look more professional.

Use Case: A freelance graphic designer generating invoices for clients across different countries.

Examples: Zoho Invoice, FreshBooks.

2. Subscription & Recurring Billing Applications

With the rise of subscription-based business models like SaaS, gyms, OTT platforms, and e-learning these apps have become essential. They handle automated billing cycles, trial periods, plan upgrades/downgrades, and even proration (charging customers fairly when they change plans mid-cycle).

Use Case: A SaaS company automating monthly billing for 10,000+ global users.

Examples: Chargebee, Recurly.

3. Utility Billing Applications

Used by telecom, electricity, water, and gas companies, these apps manage usage-based billing. They integrate with smart meters and IoT devices to calculate charges based on real consumption. They also ensure compliance with government regulations and tariffs.

Use Case: An energy provider billing customers based on real-time smart meter data.

Examples: Oracle Utilities, EnergyCAP.

4. Medical Billing Applications

Healthcare has its own billing complexities, especially with insurance claims, medical codes, and compliance (HIPAA, ICD-10, etc.). Medical billing apps streamline patient billing, insurance settlements, and integration with electronic health records (EHR).

Use Case: A hospital automating patient billing while directly submitting claims to insurance providers.

Examples: Kareo, AdvancedMD.

5. Retail & POS Billing Applications

Retailers and restaurants rely heavily on Point-of-Sale (POS) billing apps. These apps not only generate bills but also integrate with inventory management, loyalty programs, and payment gateways. They’re crucial for businesses with high-volume, fast-paced transactions.

Use Case: A restaurant generating bills while automatically updating inventory for consumed ingredients.

Examples: Square POS, Lightspeed.

6. Enterprise Billing Applications

Large enterprises need more than just invoice generation—they require multi-department billing, advanced reporting, ERP/CRM integration, and compliance with global tax laws. Enterprise billing apps often include AI-powered analytics for forecasting cash flow and optimizing revenue strategies.

Use Case: A multinational company consolidating billing across multiple subsidiaries in different countries.

Examples: SAP Billing, Oracle NetSuite.

7. Mobile Billing Applications

With the rise of the gig economy and mobile-first businesses, lightweight billing apps on smartphones have become vital. They allow professionals to generate invoices, accept digital payments, and track finances on the go.

Use Case: A food delivery partner generating receipts instantly after completing an order.

Examples: QuickBooks Mobile, Wave.

Why These Types Matter

Every type of billing app solves a unique problem from a freelancer looking for quick invoicing, to an enterprise needing compliance across borders.

As businesses go digital and embrace AI, automation, and mobile-first strategies, the demand for these specialized billing applications will continue to grow making billing software not just a tool, but a business enabler.

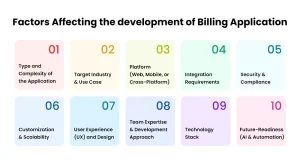

Factors Affecting the Development of Billing Application

Building a billing application whether as simple as a mobile invoicing app or as advanced as an enterprise-grade system like Zoho Invoice or Chargebee requires careful consideration of multiple factors.

These elements directly impact development cost, timeline, scalability, and long-term success.

1. Type and Complexity of the Application

The features and scope of the billing app significantly determine development efforts. For example, a basic invoicing app is far less complex than an enterprise billing system with multi-currency, AI automation, and ERP integration.

2. Target Industry & Use Case

Different industries (healthcare, utilities, SaaS, retail) demand specialized billing features. For instance, medical billing apps require compliance with ICD-10 and insurance claim modules, while subscription apps need recurring payment logic.

3. Platform (Web, Mobile, or Cross-Platform)

The choice of platform web-based, iOS, Android, or cross-platform affects development costs and performance. A cloud-first, mobile-friendly approach is trending, but businesses may still prefer hybrid solutions.

4. Integration Requirements

Billing apps rarely function in isolation. They often need to integrate with payment gateways (PayPal, Stripe, Razorpay), accounting systems (QuickBooks, Xero), CRMs, ERPs, and tax compliance APIs. More integrations mean more complexity.

5. Security & Compliance

Since billing apps handle sensitive financial data, strong encryption, PCI DSS compliance, GDPR adherence, and role-based access controls are essential. Security features can extend development timelines but are non-negotiable for user trust.

6. Customization & Scalability

Businesses increasingly want custom dashboards, branded invoices, and AI-driven analytics. Developers must design apps with modular architectures to ensure scalability as the business grows.

7. User Experience (UX) and Design

Billing can be complex, but the app should remain intuitive and easy-to-use. A poor UX increases churn rates, especially in subscription-based businesses where convenience is a top priority.

8. Team Expertise & Development Approach

The cost and efficiency depend on whether businesses hire in-house developers, outsource to an AI-driven software agency, or use low-code/no-code platforms. Agile methodologies usually work best for complex apps.

9. Technology Stack

Choosing the right tech stack (e.g., React Native, Flutter, Node.js, Python, MySQL, cloud hosting with AWS or Azure) impacts performance, maintenance, and future scalability of the billing app.

10. Future-Readiness (AI & Automation)

Modern billing applications are adopting AI for predictive analytics, fraud detection, and smart reminders. Designing the app with future trends in mind ensures long-term relevance and competitive advantage.

The development of a billing application is influenced not just by technical aspects, but also by market trends, compliance needs, and business growth strategies. Companies that carefully balance these factors build billing apps that are not only functional but also future-proof.

Read Also: AI Agent Use Cases in 2025

Future of Billing Apps: Market Trends & Business Impact

The future of billing applications is being shaped by digital transformation, AI-driven automation, and customer-first financial experiences. What was once a simple tool for generating invoices has now become a strategic enabler for businesses of all sizes.

Global reports project the billing software market to surpass $20 billion by 2030, fueled by the rise of SaaS platforms, subscription-based businesses, and mobile-first economies. Companies across industries are moving away from manual invoicing to automated billing apps to improve efficiency, compliance, and customer trust.

One of the strongest trends is the shift toward AI and predictive billing. Businesses want apps that not only record transactions but also forecast revenue, detect fraud, and remind customers before payments are due. This proactive approach reduces late payments and strengthens cash flow.

Another trend is hyper-personalization billing apps are becoming flexible enough to adapt to freelancers, SMEs, and enterprises, each with different needs. For example, freelancers need lightweight invoicing tools, while enterprises demand multi-currency, ERP integration, and compliance automation.

The rise of digital wallets, UPI, and cryptocurrency payments is also pushing billing apps to support multiple payment methods, ensuring global reach and customer convenience. At the same time, regulatory frameworks like GDPR and PCI DSS are making data security and compliance non-negotiable.

For businesses, the impact is clear:

- Faster Cash Flow → Automated reminders and easy digital payments reduce delays.

- Stronger Compliance → Built-in tax and legal compliance avoids costly errors.

- Smarter Insights → AI-powered analytics help predict revenue and improve decision-making.

- Scalability → Businesses can handle growth seamlessly without overhauling their financial systems.

In the coming years, billing apps will move beyond being financial tools to becoming business growth partners, helping companies not only manage transactions but also strategize for profitability and expansion.

Costing to Develop Billing Application

The cost of developing a billing app depends on multiple factors such as app complexity, features, integrations, security requirements, and the development team’s location. Below is an approximate breakdown:

| Factor | Details | Estimated Cost Range (USD) |

| App Complexity | Basic invoicing app with limited features (invoice generation, payment tracking). | $10,000 – $20,000 |

| Medium-Scale App | Subscription billing, multi-currency support, tax compliance, reporting dashboard. | $25,000 – $50,000 |

| Enterprise-Level App | Advanced features like AI automation, ERP/CRM integration, analytics, global compliance. | $60,000 – $120,000+ |

| Platform | Web-only vs. Web + Mobile (iOS/Android) or cross-platform development. | +$5,000 – $30,000 (depending on choice) |

| UI/UX Design | Intuitive and branded interface with user-friendly flows. | $3,000 – $10,000 |

| Integrations | Payment gateways (Stripe, PayPal, Razorpay), accounting (QuickBooks, Xero), tax APIs. | $5,000 – $15,000 |

| Security & Compliance | PCI DSS compliance, encryption, GDPR adherence. | $5,000 – $20,000 |

| Maintenance & Updates | Ongoing bug fixes, feature enhancements, server costs. | $1,500 – $5,000 per month |

On average, the development cost of a billing application ranges between $25,000 – $80,000 for small to medium-sized businesses, while enterprise-grade solutions can exceed $120,000, especially with advanced integrations and AI-driven automation.

Read Also: Software Development Cost in 2025

How will Alea help you in Developing Billing Application

Developing a billing application isn’t just about writing code—it’s about creating a secure, scalable, and future-ready financial solution that aligns with your business goals. This is where Alea stands out as your ideal technology partner.

At Alea, we bring together deep expertise in fintech, AI-driven automation, and custom software development to build billing applications tailored for startups, SMEs, and enterprises.

As a trusted custom software development company, our approach focuses on solving real-world business challenges, from managing recurring subscriptions to ensuring global tax compliance.

Here’s how we help you succeed:

- End-to-End Development Expertise- From ideation and wireframing to deployment and ongoing support, Alea manages the complete development cycle.

- Custom Feature Integration- Whether you need subscription billing, multi-currency support, ERP/CRM integration, or AI-powered analytics, we design solutions that match your exact business needs.

- Strong Focus on Security & Compliance- We ensure your app adheres to PCI DSS, GDPR, HIPAA (for medical billing), and local tax regulations, safeguarding sensitive financial data.

- Scalable Architecture- Our app developers build apps that grow with your business, capable of handling increasing users, transactions, and global expansions.

- User-Centric Design- Billing can be complex, but we design intuitive dashboards and mobile-first interfaces to make it easy for your team and customers.

- Agile & Transparent Development Process- With iterative sprints, regular updates, and clear communication, we ensure your project is delivered on time and within budget.

- Future-Ready with AI & Automation- We integrate predictive analytics, smart reminders, and fraud detection to keep your billing app ahead of industry trends.

Why Choose Alea Over Generic Developers?

| Factor | Alea | Generic Developers |

| Industry Expertise | Specialized in fintech, AI, and enterprise-grade apps with proven success in billing solutions. | Limited domain knowledge, often generalists. |

| Customization | Tailored solutions with scalable architecture designed around your business model. | Pre-built templates with limited flexibility. |

| Security & Compliance | Adheres to PCI DSS, GDPR, HIPAA, and global tax regulations, ensuring maximum data protection. | Basic security, often missing advanced compliance. |

| Integration Capabilities | Deep expertise in integrating with payment gateways, CRMs, ERPs, and tax APIs. | May struggle with complex third-party integrations. |

| Future-Ready Technology | Uses AI, automation, and predictive analytics for smarter billing. | Traditional development, lacks future-oriented features. |

| Development Approach | Agile, transparent, with regular updates and a collaborative process. | Rigid, less communication, higher chances of delays. |

| Post-Launch Support | Continuous maintenance, updates, and performance monitoring. | Limited or no support after delivery. |

Conclusion

Billing applications are no longer optional they are essential tools for modern businesses aiming to streamline financial operations, improve cash flow, and strengthen customer trust. From freelancers sending invoices to enterprises handling global transactions, billing apps play a critical role in ensuring accuracy, compliance, and efficiency.

The future points toward AI-driven automation, multi-currency support, predictive analytics, and seamless integrations, making billing software a growth enabler rather than just a utility.

By choosing the right partner, like Alea, you can develop a secure, scalable, and future-ready billing application that not only simplifies financial processes but also positions your business for long-term success in a competitive digital economy.

Frequently Asked Questions (FAQs)

Q1. What is a billing application and why is it important?

A billing application is software that helps businesses create invoices, track payments, manage subscriptions, and ensure compliance. It reduces manual errors, saves time, and improves cash flow.

Q2. How much does it cost to develop a billing app like Zoho Invoice?

The cost typically ranges from $25,000 to $80,000 for small to medium businesses, while enterprise-level solutions with advanced features can exceed $120,000.

Q3. Which industries benefit most from billing applications?

Almost every industry can benefit, but SaaS, retail, utilities, healthcare, and freelancers see the biggest impact due to recurring payments, compliance needs, and customer management.

Q4. What are the must-have features in a billing application?

Key features include invoice generation, multi-currency support, payment gateway integration, recurring billing, tax compliance, analytics dashboards, and security measures.

Q5. How long does it take to build a billing application?

The timeline varies based on complexity. A basic invoicing app may take 2–3 months, while an enterprise-level billing system could take 6–12 months or more.

Q6. Can billing apps integrate with accounting or ERP systems?

Yes, most billing apps integrate seamlessly with QuickBooks, Xero, SAP, Oracle NetSuite, and CRMs to provide end-to-end financial management.

Q7. What makes Alea the right choice for billing app development?

Alea combines fintech expertise, AI-driven automation, security-first development, and scalable architecture delivering tailored solutions that grow with your business.