The financial technology landscape has never been more promising for entrepreneurs and businesses looking to make their mark in the money management space. With personal finance becoming increasingly digital, there’s a massive opportunity to create software that rivals industry giants like Quicken.

But here’s the thing building successful money management software isn’t just about copying what already exists; it’s about understanding the evolving needs of modern users and crafting solutions that truly serve them.

Picture this: Sarah, a small business owner, sits at her kitchen table every Sunday evening, drowning in receipts and bank statements. She’s tried multiple apps, but none quite fit her unique needs.

This scenario plays out in millions of households and businesses worldwide, representing a golden opportunity for innovative software developers and Custom Software Development Companies to create tailored solutions.

The journey to develop money management software like Quicken requires more than just technical expertise it demands a deep understanding of financial workflows, user psychology, and the regulatory landscape that governs financial data.

Whether you’re a startup founder with a vision or a CTO exploring new market opportunities, this comprehensive guide will walk you through everything you need to know about creating compelling financial management software in 2026.

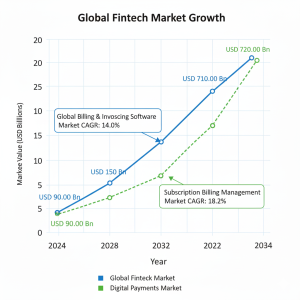

Exploring the 2026 Fintech Market: Key Stats & Insights

The fintech revolution continues to reshape how we interact with money, with the global market surging to $320.81 billion in 2026, set to reach $652.80 billion by 2030, reflecting a 15.27% CAGR. This rapid growth is driven by both consumer behavior shifts and technological innovations, making it a key player in software development trends.

What’s exciting about the current fintech landscape is its diverse opportunities. While there were 414 fintech unicorns globally in 2026, there’s still room for specialized solutions that solve niche problems. The best money management software won’t always be the biggest—it’ll be the most user-centric and innovative.

Pandemic-driven digital adoption has sped up the shift, with Gen Z seeking real-time financial insights, visual dashboards, and tools that integrate seamlessly into their lives. The regulatory landscape is also evolving, with open banking initiatives and APIs enabling more flexible, secure financial solutions.

For businesses ready to enter the space, 2026 offers a golden opportunity. The market is ripe for innovative fintech apps that understand user needs and push the boundaries of current solutions—driving the next wave of software development trends.

Features of a Money Management Software like Quicken

Creating compelling money management software starts with understanding the core features that users expect and the innovative touches that set your solution apart.

Let’s explore the essential components that form the backbone of any successful financial management platform.

1. Expense Tracking & Budgeting

The heart of any money management software lies in its ability to track expenses and facilitate budgeting with minimal user friction.

Modern users expect their software to automatically categorize transactions, learn from their behaviour, and provide intelligent insights about spending patterns.

Effective expense tracking goes beyond simple categorization. Users need the ability to split transactions across multiple categories, handle recurring expenses intelligently, and manage both business and personal expenses within the same interface when appropriate.

The best systems use machine learning to improve categorization accuracy over time, reducing the manual work required from users.

Budgeting features should be flexible enough to accommodate different financial philosophies. Some users prefer zero-based budgeting, while others want percentage-based allocations.

The software should support multiple budgeting methodologies without overwhelming users with choices. Visual representations of budget performance, including trend analysis and forecasting, help users understand not just where their money goes, but where it’s likely to go in the future.

Smart alerts and notifications play a crucial role in keeping users engaged with their financial goals. However, the key is delivering the right information at the right time, not bombarding users with constant updates.

Customizable notification preferences ensure that each user receives relevant information without notification fatigue.

2. Bank Account Integration

Seamless bank account integration is no longer a nice-to-have feature it’s a fundamental requirement for any serious money management platform.

Users expect their financial data to sync automatically across all their accounts, providing a comprehensive view of their financial situation without manual data entry.

The technical implementation of bank integration requires careful attention to security protocols and compliance requirements.

Modern solutions typically leverage API connections rather than screen scraping, providing more reliable data access while maintaining security standards.

This approach also enables real-time transaction updates, giving users immediate visibility into their financial activity.

Multi-bank support is essential, as most users maintain accounts across multiple financial institutions. The software should handle different account types seamlessly checking, savings, credit cards, investment accounts, and loans presenting them in a unified interface that makes sense to the user.

International users require additional consideration, as banking systems and regulations vary significantly across countries.

A truly comprehensive solution either focuses on specific markets with deep integration or provides flexible best frameworks that can adapt to different banking environments.

3. Investment Portfolio Management

Investment tracking capabilities distinguish comprehensive financial software from simple budgeting apps. Users need visibility into their portfolio performance, asset allocation, and investment goals within the same platform they use for day-to-day money management.

Portfolio tracking should provide real-time market data and performance analytics but presented in ways that don’t overwhelm non-expert users.

Visual representations of asset allocation, performance over time, and goal progress help users make informed decisions about their investments without requiring deep financial expertise.

Tax optimization features add significant value for investment-focused users. Capabilities like tax-loss harvesting suggestions, cost basis tracking, and capital gains analysis help users minimize their tax burden while maintaining their investment strategy.

Integration with popular investment platforms and brokerages extends the software’s utility. Rather than requiring users to manually update investment information, automatic synchronization ensures that portfolio data remains current and accurate.

4. Bill Payment & Reminders

Bill management functionality transforms money management software from a passive tracking tool into an active financial assistant. Users need reliable reminder systems that help them avoid late fees while maintaining control over their payment timing.

Smart bill detection can automatically identify recurring payments from transaction history and set up reminder schedules without user intervention. This feature is particularly valuable for users transitioning from manual bill management or other financial tools.

Payment integration capabilities vary in complexity and regulatory requirements. Some solutions offer full bill pay functionality, while others focus on reminder and tracking features. The choice depends on the target market and the development team’s willingness to navigate payment processing regulations.

Flexible scheduling options accommodate different payment preferences. Some users prefer to pay bills immediately upon receipt, while others batch payments on specific dates. The software should support both approaches while providing clear visibility into upcoming payment obligations.

5. Smart Financial Reports

Comprehensive reporting capabilities help users understand their financial trends and make informed decisions about their money. However, the challenge lies in presenting complex financial information in digestible, actionable formats.

Automated report generation should provide insights that users might not discover on their own. Cash flow analysis, spending trend identification, and goal progress tracking offer value beyond simple transaction listing. The best reporting features use data analysis to highlight opportunities for improvement or potential concerns.

Customizable reporting allows users to focus on the metrics most relevant to their situation. A small business owner needs different insights than a retiree, and the reporting interface should accommodate these different perspectives without becoming overly complex.

Export capabilities are essential for users who need to share financial information with accountants, tax preparers, or business partners. Support for common formats like CSV, PDF, and Excel ensures that data can be used in external tools when needed.

6. Multi-Device & Cloud Syncing

Modern users expect their financial information to be available across all their devices, with seamless synchronization ensuring data consistency regardless of access point. This capability requires robust backend architecture and careful attention to data security.

Cross-platform compatibility extends beyond simple data synchronization to include optimized user interfaces for different device types. The desktop experience might emphasize comprehensive data entry and analysis, while mobile interfaces focus on quick transaction entry and key metric monitoring.

Offline functionality adds resilience to the user experience. Users should be able to access critical information and perform basic tasks even when internet connectivity is limited. Synchronization processes should handle offline changes gracefully when connectivity is restored.

Security considerations for cloud-based financial data storage require implementation of industry-standard encryption, secure authentication, and compliance with relevant data protection regulations.

Users trust financial software with their most sensitive information, and any security breach can be devastating to both users and the software provider.

Read Also: How to Develop Remote Access Software Like TeamViewer

Key Benefits of Developing Money Management Software Like Quicken

Understanding the benefits of developing money management software helps inform strategic decisions throughout the development process.

These benefits extend beyond immediate functionality to encompass long-term value creation for both users and software providers.

1. Better Financial Planning

Comprehensive financial software empowers users to make informed decisions about their money by providing clear visibility into their financial situation and trends.

This visibility extends beyond simple account balances to include cash flow forecasting, goal tracking, and scenario modelling.

Effective financial planning tools help users identify opportunities for optimization that might otherwise go unnoticed.

For example, automated analysis might reveal that a user consistently overspends in certain categories during specific months, enabling proactive budget adjustments.

Long-term financial goal tracking transforms abstract objectives into concrete, measurable targets. Whether users are saving for a house, planning for retirement, or building an emergency fund, well-designed software provides the structure and motivation needed to achieve these goals.

Educational components within the software can help users develop better financial habits over time. Rather than simply tracking transactions, the best solutions provide insights and suggestions that help users understand the implications of their financial decisions.

2. Automated Savings and Budgeting

Automation reduces the friction associated with good financial habits, making it easier for users to save money and stick to their budgets.

Smart automation features can analyse spending patterns and automatically transfer excess funds to savings accounts or investment vehicles.

Rule-based automation allows users to set up complex financial workflows without manual intervention. For example, users might automatically allocate bonuses or unexpected income according to predefined percentages across different goals.

Behavioural automation leverages psychological insights to encourage positive financial behaviours. Features like automatic round-up savings or challenge-based saving programs make financial management more engaging and less burdensome.

Budget automation goes beyond simple expense tracking to include predictive budgeting based on historical patterns and known upcoming expenses. This approach helps users avoid budget surprises and maintain better control over their financial resources.

3. Secure Transactions and Data Protection

Financial software must prioritize security above all other considerations. Users entrust these applications with their most sensitive information, and any security failure can have devastating consequences.

Multi-layered security approaches combine encryption, authentication, and monitoring to protect user data at every level. This includes data encryption both in transit and at rest, multi-factor authentication options, and continuous monitoring for suspicious activity.

Compliance with financial regulations isn’t optional it’s a fundamental requirement for any legitimate financial software. This includes adherence to standards like PCI DSS for payment processing, SOC 2 for data handling, and various regional privacy regulations.

Transparency about security practices builds user trust and confidence. Clear communication about data handling, security measures, and privacy policies helps users make informed decisions about sharing their financial information.

4. Revenue Generation for Businesses

Well-designed money management software creates multiple revenue opportunities through various monetization strategies. Subscription models provide predictable recurring revenue, while premium features offer upselling opportunities.

Partnership opportunities with financial institutions, investment platforms, and other service providers can create additional revenue streams through referral fees and integrated services. These partnerships can also enhance the software’s functionality without increasing development costs.

Data insights (properly anonymized and aggregated) can provide valuable market intelligence that has commercial value. However, any data monetization strategy must be transparent to users and comply with privacy regulations.

Business-focused versions of consumer financial software often command higher prices while requiring minimal additional development.

The same core functionality that helps individuals manage their money can be adapted for small business accounting and financial management.

5. Scalability and Future Expansion

Building financial software with scalability in mind ensures that the platform can grow with both individual users and the overall user base. This includes technical scalability to handle increased transaction volumes and feature scalability to accommodate evolving user needs.

Modular architecture enables rapid feature development and customization without disrupting core functionality. This approach makes it easier to add new integrations, expand into new markets, or develop specialized versions for specific user segments.

International expansion opportunities abound in the financial software space, but require careful consideration of local banking systems, currencies, and regulatory requirements. Software designed with internationalization in mind can more easily enter new markets as opportunities arise.

Platform evolution capabilities allow the software to adapt to changing technology trends and user expectations. Whether that’s incorporating new payment methods, blockchain technologies, or AI-driven insights, flexible architecture ensures long-term viability.

Read Also: How to Develop an AI-Powered HRM Software

Quicken Software Alternatives

The competitive landscape for personal finance software offers valuable insights into user preferences and market opportunities. Examining existing quicken alternatives helps identify both successful features and unmet user needs.

1. Mint

Mint revolutionized free personal finance software by combining comprehensive features with an advertising-supported business model. Its success demonstrates the viability of free financial software, though recent changes to the platform have created opportunities for alternatives.

The strength of Mint lay in its simplicity and comprehensive bank integration. Users could connect virtually any financial account and get a complete picture of their financial situation without paying subscription fees. However, the trade-off was limited customization and frequent advertising interruptions.

Mint’s approach to expense categorization and budgeting influenced many subsequent applications. The automatic transaction categorization, combined with visual budget tracking, set user expectations for how financial software should behave.

The recent discontinuation of Mint by Intuit created a significant market opportunity for alternatives. Millions of users are actively seeking replacement solutions, representing a substantial addressable market for new entrants.

2. YNAB (You Need a Budget)

YNAB’s success demonstrates that users are willing to pay premium prices for software that genuinely helps them improve their financial habits. The company’s focus on education and behaviour change, rather than just transaction tracking, creates strong user loyalty and low churn rates.

The zero-based budgeting methodology promoted by YNAB appeals to users who want more intentional control over their money. This approach requires more initial setup and ongoing maintenance than passive tracking apps but provides greater insight into spending decisions.

YNAB’s emphasis on educational content and community support creates additional value beyond the core software functionality. Users often become advocates for the platform because it genuinely improves their financial situation.

The subscription pricing model ($109 annually) proves that users value financial software enough to pay significant ongoing fees. However, this also creates an opportunity for more affordable alternatives that provide similar functionality.

3. QuickBooks

While primarily positioned as business accounting software, QuickBooks demonstrates the potential for financial software that serves both business and personal use cases. Many small business owners use QuickBooks for personal financial management as well as business accounting.

The integration between business and personal financial management appeals to entrepreneurs and freelancers who need visibility into both sides of their financial picture. This dual functionality can justify higher software costs by serving multiple purposes.

QuickBooks’ extensive integration ecosystem shows the value of building platforms that support third-party extensions. This approach accelerates feature development and allows the software to serve niche use cases without direct development investment.

The complexity of QuickBooks also highlights the importance of user experience design. While the software is incredibly powerful, many users find it overwhelming for simple personal finance tasks.

4. Tiller Money

Tiller’s spreadsheet-based approach appeals to users who want powerful customization capabilities without sacrificing familiar interfaces. This model demonstrates that innovation in financial software doesn’t always require completely new user experiences.

The combination of automated data import with spreadsheet flexibility provides users with both convenience and control. Advanced users can create complex analysis and reporting while less technical users can stick to provided templates.

Tiller’s success shows that there’s still demand for desktop-focused financial software, despite the industry trend toward web and mobile applications. Some users prefer the reliability and performance of local software over cloud-based alternatives.

The educational approach taken by Tiller, including extensive documentation and community support, helps users maximize the value they receive from the software.

Real-World Use Cases for Money Management Software

Understanding how different user segments actually use financial software informs both feature development and marketing strategies. Real-world use cases reveal the gap between theoretical functionality and practical user needs.

1. Personal Finance Management

Individual users represent the largest market segment for money management software, but their needs vary significantly based on life stage, income level, and financial sophistication. Young professionals might prioritize student loan tracking and emergency fund building, while retirees focus on investment income and healthcare expense planning.

Effective personal finance software must accommodate different financial philosophies and management styles. Some users prefer detailed tracking of every expense, while others want high-level visibility with minimal data entry requirements.

Life event management represents a significant opportunity for personal finance software. Major changes like marriage, home purchases, job changes, or having children require financial planning adjustments that software can facilitate and automate.

Integration with lifestyle apps and services enhances the value proposition for personal users. Connections to fitness apps, travel booking services, and shopping platforms provide comprehensive views of how lifestyle choices impact financial resources.

2. Small Business Accounting

Small business owners often struggle with the complexity and cost of traditional business accounting software. Money management software that can handle both business and personal finances addresses a significant pain point for entrepreneurs and freelancers.

Invoice management and cash flow forecasting are critical features for business users. The ability to track outstanding invoices, predict cash flow gaps, and manage business expenses separately from personal spending provides essential business functionality.

Tax preparation support becomes even more important for business users, who face more complex reporting requirements and potential audit exposure. Integration with tax preparation software or built-in tax reporting features add significant value.

Scalability considerations are crucial for business-focused software. What works for a single-person consulting business may not suffice for a company with multiple employees and complex financial requirements.

3. Investment & Wealth Tracking

High-net-worth individuals require sophisticated investment tracking capabilities that go beyond basic portfolio monitoring. This includes alternative investments, tax optimization strategies, and estate planning considerations.

Multi-generational wealth management represents an underserved niche in the financial software market. Families with significant assets often need tools that can track wealth across multiple family members and investment vehicles.

Performance benchmarking helps investment-focused users evaluate their portfolio performance against relevant market indices and investment goals. This functionality requires access to comprehensive market data and analytical capabilities.

Risk assessment tools help users understand their portfolio’s risk profile and make informed decisions about asset allocation. This includes scenario modelling and stress testing capabilities.

4. Subscription & Bill Management

The increasing complexity of modern subscription services creates opportunities for specialized financial management features. Users often struggle to track recurring payments across multiple services and platforms.

Subscription optimization features can help users identify underutilized services and negotiate better rates for essential services. This functionality provides tangible value that justifies software costs.

Automated bill management goes beyond simple reminders to include payment optimization. Features like early payment discounts detection and cash flow timing optimization help users minimize costs and maximize financial efficiency.

Integration with subscription services enables automatic cancellation of unwanted services and negotiation of better rates for retained services. This functionality transforms financial software from a passive tracking tool into an active financial management assistant.

Read Also: How to Develop Human Capital Management Software

Step-by-Step Development Process for a Money Management Software like Quicken

Building successful financial software requires a systematic approach that balances user needs, technical requirements, and business objectives. The development process must account for the unique challenges of financial data security, regulatory compliance, and user trust.

1. Define Project Scope & Objectives

The success of any software project starts with clearly defining what you’re building and why. For money management software, this means understanding your target market’s pain points and how your solution can address them better than existing options.

Work with software development companies to dive deep into market research—conduct user interviews, analyze competitor reviews, and identify gaps in current solutions. Focus on creating a minimum viable product (MVP) with core features that provide immediate value, while planning for future growth.

Set clear success metrics from the start, like user acquisition and engagement rates, and keep regulatory requirements in mind to avoid costly redesigns later.

2. Choose the Right Technology Stack

Technology stack decisions have long-lasting implications for software scalability, security, and development efficiency. For financial software, security and reliability should be primary considerations, sometimes taking precedence over cutting-edge technology trends.

Backend architecture must support secure data handling, real-time transaction processing, and integration with multiple financial institutions. Cloud-based solutions offer scalability advantages but require careful security implementation. Consider factors like data residency requirements, backup and disaster recovery capabilities, and compliance certifications when selecting cloud providers.

Database selection impacts both performance and security. Financial data requires robust encryption, audit trails, and backup capabilities. Consider both SQL and NoSQL options based on your data structure requirements and scaling needs.

API integration requirements are extensive for financial software. You’ll need connections to banks, payment processors, investment platforms, and data providers. Choose technologies that facilitate secure API integration and provide robust error handling for external service failures.

Frontend technology should prioritize user experience while maintaining security standards. Consider the development team’s expertise, long-term maintenance requirements, and cross-platform compatibility needs when making framework decisions.

3. UI/UX Design

User experience design for financial software faces unique challenges. Users need access to complex information and functionality while maintaining simplicity and trust. The interface must feel both professional and approachable, secure yet convenient.

Information architecture requires careful consideration of how users naturally think about their finances. Organize features and data according to user mental models rather than technical implementation logic. This might mean presenting business and personal finances differently or providing multiple views of the same data for different use cases.

Visual design should inspire confidence while remaining approachable. Financial software users span a wide demographic range, so the design must work for both tech-savvy millennials and less technical older users. Consider accessibility requirements throughout the design process.

Mobile-first design has become essential for financial software, as users increasingly expect to manage their finances on their phones. However, desktop functionality remains important for detailed analysis and data entry tasks. Design responsive interfaces that work well across all device types.

Security indicators and trust signals must be integrated naturally into the user interface. Users need confidence that their data is secure without being overwhelmed by security warnings and technical details.

4. Core Feature Development

Feature development for financial software requires careful attention to data accuracy, security, and user workflow optimization. Start with core functionality like account integration and transaction tracking before building advanced features.

Account integration development involves navigating multiple APIs, security protocols, and data formats. Plan for extensive testing with different financial institutions and account types. Build robust error handling for API failures and data inconsistencies.

Transaction processing must handle edge cases like pending transactions, split payments, and international transactions. Implement comprehensive data validation and error correction mechanisms to maintain data integrity.

Security implementation should be ongoing throughout development, not an afterthought. This includes data encryption, secure authentication, API security, and audit logging. Regular security reviews and penetration testing help identify vulnerabilities before they become problems.

Performance optimization becomes critical as data volumes grow. Financial software users often have years of transaction history, requiring efficient data storage and retrieval mechanisms. Plan for data archiving and performance scaling from the beginning.

5. Testing & QA

Quality assurance for financial software requires more rigorous testing than most applications due to the critical nature of financial data. Users have zero tolerance for data loss, calculation errors, or security breaches.

Functional testing must cover all user workflows, edge cases, and integration points. This includes testing with real financial data from multiple institutions, various transaction types, and different user scenarios. Automated testing helps ensure consistent quality as features evolve.

Security testing should include penetration testing, vulnerability scanning, and compliance audits. Engage external security experts to validate your security implementation and identify potential weaknesses.

Performance testing must account for varying data loads and concurrent user activities. Financial software usage often spikes during certain periods (like tax season), requiring infrastructure that can handle peak loads without degradation.

User acceptance testing with real users provides insights that technical testing cannot capture. Beta testing programs help identify usability issues and workflow problems before general release.

6. Deployment & Maintenance

Deployment planning for financial software must prioritize uptime and data integrity. Users expect their financial information to be available 24/7, with minimal downtime for updates and maintenance.

Security monitoring becomes a continuous operational requirement. Implement comprehensive logging, anomaly detection, and incident response procedures. Regular security updates and patches must be applied promptly without disrupting user access.

Data backup and disaster recovery procedures are critical for financial software. Users’ financial data represents years of history that cannot be recreated if lost. Implement robust backup systems with regular recovery testing.

Customer support capabilities must address both technical issues and financial concerns. Users may need help with data accuracy, account integration problems, or understanding financial reports. Provide multiple support channels and comprehensive documentation.

Software Development Cost

Understanding the software development cost structure for developing money management software helps stakeholders make informed decisions about project scope, timeline, and resource allocation.

Development costs vary significantly based on feature complexity, team composition, and quality requirements.”

1. Features and Functionality

The feature set directly impacts development cost, with financial software requiring specialized functionality that takes more time to implement than standard application features.

Basic expense tracking and budgeting features represent the foundation layer, typically requiring 3-6 months of development depending on team size and expertise.

Advanced features like investment tracking, tax optimization, and automated bill pay can double or triple development time.

These features require integration with external services, complex calculations, and sophisticated user interfaces. Consider phasing feature development to balance time-to-market with functionality completeness.

Reporting and analytics capabilities add significant development complexity. Custom report generation, data visualization, and export functionality require specialized expertise and extensive testing. However, these features often differentiate successful financial software from basic alternatives.

Security and compliance features represent necessary investments that don’t directly provide user-facing functionality but are essential for financial software credibility. Budget for security audits, compliance documentation, and ongoing security maintenance.

Integration capabilities with banks, investment platforms, and other financial services require ongoing development and maintenance. Each integration point adds complexity and potential failure points that must be managed throughout the software lifecycle.

2. Design Complexity

“User interface design for financial software must balance complexity with usability, often requiring more design iterations and user testing than simpler applications.

Finance software development services typically allocate 15-25% of the total development budget to professional design services for financial software.”

Responsive design requirements for financial software are particularly challenging because users need access to detailed information on both desktop and mobile devices. This often requires creating different user flows for different device types while maintaining data consistency.

Custom visualization and charting capabilities for financial data require specialized design expertise. Off-the-shelf charting libraries may not provide the specific functionality needed for financial analysis, necessitating custom development.

Accessibility compliance adds design complexity but is increasingly important for reaching diverse user bases. This includes support for screen readers, keyboard navigation, and visual impairments.

Brand development and visual identity creation for financial software must inspire trust while differentiating from competitors. This includes logo design, colour schemes, typography, and overall visual language that communicates professionalism and security.

3. Development Team

Team composition significantly impacts both development cost and timeline. Financial software requires developers with specific expertise in security, API integration, and financial calculations. Specialized knowledge commands higher rates but reduces development time and improves quality.

Full-stack developers with financial software experience represent the most efficient option for smaller projects. However, larger projects benefit from specialized roles including backend developers, frontend developers, security experts, and DevOps engineers.

Geographic location of development team affects cost structure. While offshore development can reduce hourly rates, financial software requirements for security and compliance often Favor local teams with easier communication and regulatory alignment.

Project management expertise becomes critical for financial software projects due to regulatory requirements, security considerations, and integration complexity. Experienced project managers help avoid costly delays and ensure compliance requirements are met.

Quality assurance specialists with financial software experience add significant value through specialized testing knowledge and understanding of financial data edge cases.

4. Third-Party Integrations

Bank integration services typically charge setup fees plus ongoing transaction costs. Budget for multiple integration partners to ensure comprehensive bank coverage. Costs can range from $10,000 to $50,000 for initial setup plus $0.01 to $0.10 per transaction.

Payment processing integration involves both development costs and ongoing transaction fees. Consider the trade-offs between integrated payment solutions and standalone payment processors based on your specific use cases.

Data provider services for investment tracking, market data, and financial news require ongoing subscription costs that scale with user base. These services often have minimum monthly fees plus usage-based pricing.

Credit monitoring and identity verification services add both integration costs and ongoing fees. However, these features can provide significant user value and differentiation opportunities.

Tax preparation software integration requires specialized development and ongoing maintenance to keep up with tax law changes. Consider the development cost against the user value and retention benefits.

5. Estimated Cost Ranges

Small-scale personal finance applications with basic features typically require $50,000 to $150,000 in initial development costs. This includes core expense tracking, budgeting, and basic reporting functionality with a simple user interface.

Medium-complexity applications with advanced features like investment tracking, bill pay, and comprehensive reporting typically cost $150,000 to $400,000. This includes professional design, multiple integrations, and mobile applications.

Enterprise-grade financial software with comprehensive features, advanced security, and scalability for large user bases typically requires $400,000 to $1,000,000 in initial development. This includes extensive testing, security audits, and compliance documentation.

Ongoing maintenance and development costs typically represent 15-25% of initial development cost annually. This includes security updates, new feature development, integration maintenance, and infrastructure costs.

These ranges assume development by experienced teams with financial software expertise. Less experienced teams may offer lower initial costs but often require more time and result in higher total project costs due to rework and quality issues.

Critical Considerations While Developing a Finance Software like Quicken

Financial software development involves unique challenges that don’t exist in other application categories. These considerations must be addressed comprehensively to create successful, trustworthy financial management tools.

1. Data Security

Financial data represents the most sensitive information users share with software applications. Security implementation must exceed standard practices and anticipate sophisticated attack vectors specifically targeting financial applications.

Encryption requirements extend beyond basic SSL connections to include database encryption, backup encryption, and secure key management. Implement end-to-end encryption for sensitive data and ensure encryption keys are managed separately from encrypted data.

Authentication systems must support multiple factors while remaining user-friendly. Consider biometric authentication, hardware tokens, and risk-based authentication that adapts security requirements based on user behaviour and access patterns.

API security requires careful implementation of rate limiting, input validation, and secure token management. Financial APIs are frequent targets for attacks, requiring robust monitoring and automated threat detection.

Regular security audits and penetration testing help identify vulnerabilities before they can be exploited. Engage external security experts familiar with financial software to validate your security implementation.

Incident response planning becomes critical when handling financial data. Develop procedures for data breach notification, user communication, and regulatory reporting. Practice incident response procedures regularly to ensure effective execution during actual incidents.

2. User Experience (UX)

Financial software user experience must balance comprehensive functionality with simplicity and trust. Users need access to complex financial information while maintaining confidence in the software’s reliability and security.

Trust indicators throughout the user interface help users feel confident about sharing sensitive financial information. This includes security badges, clear privacy policies, and transparent communication about data handling practices.

Error handling and data validation must be comprehensive yet user-friendly. Financial calculations must be accurate, and any errors must be communicated clearly with guidance for resolution.

Onboarding processes for financial software are particularly critical because initial setup complexity can prevent user adoption. Provide clear guidance for account integration while maintaining security best practices.

Progressive disclosure helps manage interface complexity by showing advanced features only when needed. Design information architecture that works for both novice and expert users without overwhelming either group.

Accessibility compliance ensures your software reaches the broadest possible user base. Financial exclusion often affects users with disabilities, making accessibility both a business opportunity and social responsibility.

3. Compliance with Financial Regulations

Financial software operates within complex regulatory environments that vary by country and user type. Compliance requirements affect feature design, data handling, and operational procedures.

Data protection regulations like GDPR, CCPA, and similar laws require specific handling of personal financial information. Implement data deletion capabilities, consent management, and transparent privacy practices.

Financial services regulations may apply depending on your software’s functionality. Bill pay features, investment advice, and credit monitoring capabilities may trigger additional licensing and compliance requirements.

Anti-money laundering (AML) and Know Your Customer (KYC) requirements may apply to certain features. Understand when these requirements are triggered and implement appropriate verification and monitoring procedures.

Regular compliance audits help ensure ongoing adherence to regulatory requirements as laws evolve. Engage legal experts familiar with financial software regulations to guide compliance implementation.

Documentation and audit trails become critical for demonstrating compliance during regulatory examinations. Implement comprehensive logging and maintain documentation of compliance procedures and decisions.

Conclusion

Now that you understand the opportunities and challenges of building money management software like Quicken in 2026, it’s time to take the next step turning your idea into reality.

Developing fintech software can feel complex due to regulations, security, and the need for a seamless user experience. But with the right technology partner, the journey becomes much smoother.

At AleaIT Solutions, a leading finance software development company, we specialize in building secure, scalable, and user-focused financial applications.

From integrating advanced features like AI-driven automation to ensuring compliance with GDPR, PCI-DSS, and global security standards, our expertise helps businesses confidently launch next-gen fintech products.

Whether you’re a startup founder, an entrepreneur, or an enterprise leader, our team can transform your money management app idea into a market-ready solution that delivers real financial clarity and value to users.

Frequently Asked Questions (FAQs)

1. What is money management software and how does it work?

Money management software helps individuals and businesses track expenses, manage budgets, monitor investments, and plan financial goals. It integrates with bank accounts, credit cards, and other financial platforms to give users a real-time view of their finances.

2. How much does it cost to develop money management software like Quicken?

The cost varies depending on features, integrations, and design complexity. A basic version can cost between $50,000 – $150,000, while advanced, enterprise-grade solutions may range from $400,000 – $1M

3. What features should money management software include?

Essential features include expense tracking, budgeting, bank account integration, investment portfolio management, bill payment reminders, smart financial reports, and multi-device syncing

4. What are the best alternatives to Quicken?

Some popular Quicken alternatives are Mint, YNAB (You Need a Budget), QuickBooks, and Tiller Money, each catering to different user needs and pricing preferences

5. Is Quicken still available in 2026?

Yes, but many users are exploring alternatives due to pricing and feature limitations. The discontinuation of Mint by Intuit has also pushed more users to search for new solutions.

6. How secure is financial management software?

Security is critical. Reliable solutions implement bank-level encryption, multi-factor authentication, and compliance with PCI DSS, GDPR, and other financial regulations

7. Can money management software help small businesses too?

Yes. Many platforms include invoice management, cash flow forecasting, and tax preparation support, making them ideal for freelancers, entrepreneurs, and small businesses

8. What’s the difference between budgeting apps and full money management software?

Budgeting apps mainly focus on tracking income and expenses, while full financial management platforms offer advanced features like investment tracking, bill payments, reporting, and business accounting.

9. How long does it take to build software like Quicken?

On average, it takes 6–12 months to build a robust MVP (minimum viable product) and longer for enterprise-grade solutions with advanced integration

10. How can I get started building my own money management app?

Start by defining your target audience and must-have features. Then, partner with a custom software development company that specializes in fintech and compliance-driven solutions to bring your vision to life.