Digital wallets have revolutionized how we handle money, making cashless transactions seamless and secure. From buying coffee to transferring funds internationally, e-wallet apps have become an essential part of our daily lives.

If you’re planning to build an e-wallet app, understanding the app development cost is crucial for budgeting and strategic planning.

The investment can range from $40,000 to over $300,000, depending on features, complexity, and your development approach.

This guide breaks down everything you need to know about mobile app development cost for e-wallets. Whether you’re a startup founder or a fintech entrepreneur, you’ll get clear insights into pricing, factors affecting costs, and strategies to optimize your investment.

What is an E-Wallet App?

An e-wallet app is a digital platform that stores payment information securely, allowing users to make transactions without physical cards or cash. Think of it as a virtual wallet on your smartphone that holds credit cards, debit cards, loyalty cards, and even cryptocurrencies.

E-wallets work through secure authentication and encryption protocols. Users link their bank accounts or cards to the app, then use it to pay merchants, transfer money to friends, or shop online. Popular examples include PayPal, Venmo, Google Pay, and Apple Pay.

The digital wallet development process involves creating intuitive interfaces, robust security systems, and seamless payment processing. A professional wallet app development company ensures that all these elements work together flawlessly while complying with financial regulations.

E-Wallet App Market Statistics in 2026

The e-wallet / digital wallet market continues to experience rapid growth, with projections varying based on methodology and definition. Here are the updated statistics:

-

Global Market Size: Estimated at ~USD 3.2–3.6 trillion in value by 2026, growing at a CAGR of ~18–21% toward 2030.

-

Transaction Value: Global digital wallet transaction value exceeds USD 12 trillion in 2026, up from ~USD 7–8 trillion in the early 2020s.

-

Growth Outlook: Market projected to reach USD 7.8+ trillion by 2030 (MarkNtel Advisors), maintaining ~20% CAGR.

-

User Adoption: Over 5 billion users globally by 2026, representing 60%+ of the world’s population.

-

E-commerce Share: Digital wallets account for 50%+ of global e-commerce payments.

-

Regional Leader: Asia-Pacific remains the largest and fastest-growing market.

Read More: Mobile App Statistics & Trends

E-Wallet App Development Cost: Complete Breakdown

Understanding the cost structure helps you plan your budget effectively. Here’s a comprehensive breakdown of eWallet app development cost based on complexity levels.

Estimated E-Wallet App Development Costs by Complexity

| App Type | Features | Timeframe | Cost Range |

| Basic E-Wallet | User registration, basic payments, transaction history, simple security | 3-4 months | $40,000 – $80,000 |

| Mid-Level E-Wallet | All basic features + QR/NFC, biometric auth, multi-currency, analytics | 5-7 months | $80,000 – $150,000 |

| Advanced E-Wallet | All mid-level + AI/ML, blockchain, IoT, advanced analytics, loyalty programs | 8-12 months | $150,000 – $250,000 |

| Enterprise E-Wallet | Custom infrastructure, full compliance suite, advanced security, white-label solutions | 12+ months | $250,000 – $500,000+ |

Cost Comparison by Region

The digital wallet app development cost varies significantly based on where your development team is located.

| Region | Hourly Rate | Basic App Cost | Advanced App Cost |

| North America (USA, Canada) | $100 – $250/hour | $100,000 – $150,000 | $250,000 – $500,000 |

| Western Europe (UK, Germany, France) | $80 – $180/hour | $80,000 – $120,000 | $200,000 – $400,000 |

| Eastern Europe (Poland, Ukraine, Romania) | $40 – $80/hour | $40,000 – $70,000 | $120,000 – $220,000 |

| Asia (India, Philippines, Vietnam) | $25 – $60/hour | $30,000 – $55,000 | $90,000 – $180,000 |

| Latin America (Brazil, Argentina, Mexico) | $30 – $70/hour | $35,000 – $60,000 | $100,000 – $200,000 |

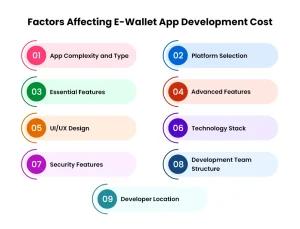

Factors Affecting E-Wallet App Development Cost

Factor 1: App Complexity and Type

The complexity of your e-wallet directly impacts development costs. A simple wallet with basic payment features requires less investment than a sophisticated platform with advanced capabilities.

Closed wallets work only with specific merchants (like Starbucks app) and are the least expensive to develop. Semi-closed wallets allow transactions with multiple merchants within a network, requiring more integration work.

Open wallets offer full banking features including withdrawals and deposits, demanding extensive regulatory compliance and security. Cryptocurrency and NFT-based wallets add another layer of complexity with blockchain integration, smart contracts, and decentralized architecture.

Factor 2: Platform Selection

Platform choice significantly affects your mobile app development cost iOS development typically requires 15-20% less time than Android due to fewer device variations and standardized hardware.

Android development covers a broader user base but involves testing across thousands of device types. This increases QA time and costs by approximately 25-30% compared to iOS.

Cross-platform development using React Native or Flutter reduces costs by 30-40% since you’re building one codebase for both platforms. However, complex features might still require native development for optimal performance.

Web-based wallet solutions are the most cost-effective, starting at $25,000-$40,000. They work across all devices through browsers but offer limited functionality compared to native apps.

Factor 3: Essential Features

Essential features form the foundation of any digital wallet development project. User registration and authentication typically cost $3,000-$8,000, depending on complexity.

Payment processing integration with gateways like Stripe or PayPal ranges from $5,000-$15,000. This includes transaction handling, refunds, and payment verification systems.

Transaction history with filters and search functionality adds $2,500-$6,000 to your budget. QR code scanning and NFC integration for contactless payments cost approximately $4,000-$10,000.

Biometric security (fingerprint, face recognition) is now mandatory for modern e-wallets. Implementation costs range from $5,000-$12,000, significantly impacting the overall eWallet app development cost.

| Essential Feature | Development Time | Cost Range |

| User Registration & Authentication | 40-80 hours | $3,000 – $8,000 |

| Payment Processing | 80-150 hours | $5,000 – $15,000 |

| Transaction History | 30-60 hours | $2,500 – $6,000 |

| QR Code & NFC | 50-100 hours | $4,000 – $10,000 |

| Biometric Security | 60-120 hours | $5,000 – $12,000 |

| Push Notifications | 20-40 hours | $2,000 – $5,000 |

| Customer Support Chat | 40-80 hours | $3,500 – $8,000 |

Factor 4: Advanced Features

Advanced features differentiate your wallet from competitors but increase investment significantly. AI and machine learning integration for fraud detection and personalized recommendations costs $15,000-$40,000.

Multi-currency support with real-time exchange rates adds complexity, ranging from $8,000-$20,000. This feature is essential for international wallets serving global users.

Loyalty programs and rewards systems require custom backend development, costing $10,000-$25,000. IoT and wearable integration for smartwatch payments adds another $12,000-$30,000.

Blockchain integration for cryptocurrency support is one of the most expensive features, ranging from $25,000-$80,000. When you hire eWallet app developers with blockchain expertise, rates are typically 40-50% higher than standard development.

These advanced capabilities often require custom eWallet app development services with specialized expertise, justifying the premium investment for competitive advantage.

| Advanced Feature | Development Time | Cost Range |

| AI/ML Integration | 150-300 hours | $15,000 – $40,000 |

| Multi-Currency Support | 80-200 hours | $8,000 – $20,000 |

| Loyalty Programs | 100-250 hours | $10,000 – $25,000 |

| IoT & Wearable Integration | 120-300 hours | $12,000 – $30,000 |

| Blockchain Integration | 250-600 hours | $25,000 – $80,000 |

| Voice Commands | 60-150 hours | $6,000 – $18,000 |

| Advanced Analytics | 100-200 hours | $10,000 – $22,000 |

Factor 5: UI/UX Design

Design quality directly impacts user adoption and retention. Basic template-based designs cost $5,000-$12,000 and work well for MVP launches or budget-conscious projects.

Custom designs with unique branding, illustrations, and animations range from $15,000-$35,000. This includes user research, wireframing, prototyping, and multiple revision rounds. Premium design with advanced micro-interactions, custom illustrations, and motion design can exceed $40,000-$60,000.

| Design Type | Deliverables | Cost Range |

| Basic Design | Template-based UI, 15-20 screens | $5,000 – $12,000 |

| Custom Design | Brand identity, 25-35 screens, prototypes | $15,000 – $35,000 |

| Premium Design | Full UX research, 40+ screens, animations | $40,000 – $60,000 |

Factor 6: Technology Stack

Your technology choices impact both development speed and long-term maintenance costs. Frontend technologies like React Native or Flutter enable faster development while maintaining quality.

When choosing mobile app development frameworks, the backend plays a crucial role in scalability and performance. Frameworks such as Node.js, Python Django, or Ruby on Rails help ensure robustness with backend development costs ranging from $20,000 to $50,000 depending on complexity and load requirements.

Database solutions like PostgreSQL or MongoDB for transaction data require careful architecture planning. Cloud infrastructure from AWS, Google Cloud, or Azure adds $500-$3,000 monthly for hosting and services.

Payment gateway integration varies by provider. Stripe costs $5,000-$10,000 to integrate, while custom payment solutions can exceed $30,000-$70,000. Professional application development services ensure optimal stack selection for your specific requirements.

Working with a specialized digital payment app development company ensures you get the right technology mix for security, scalability, and performance.

Read Also: Native Apps vs Hybrid Apps: Which One to Choose

| Technology Component | Options | Cost Range |

| Frontend | React Native, Flutter, Native iOS/Android | $15,000 – $40,000 |

| Backend | Node.js, Python, Ruby, Java | $20,000 – $50,000 |

| Database | PostgreSQL, MongoDB, MySQL | $5,000 – $15,000 |

| Payment Gateway | Stripe, PayPal, Braintree, Custom | $5,000 – $30,000 |

| Cloud Infrastructure | AWS, Google Cloud, Azure | $500 – $3,000/month |

| APIs & Third-party | SMS, Email, KYC, Analytics | $3,000 – $12,000 |

Factor 7: Security Features

Security is non-negotiable for e-wallet apps handling sensitive financial data. End-to-end encryption implementation costs $8,000-$18,000 and protects data transmission between users and servers.

Two-factor authentication (2FA) via SMS, email, or authenticator apps adds $4,000-$10,000. Tokenization for secure payment processing ranges from $6,000-$15,000.

PCI-DSS compliance requires extensive security audits and implementations, costing $15,000-$40,000 initially. Annual maintenance and re-certification add $5,000-$15,000 yearly.

Fraud detection systems using machine learning cost $20,000-$50,000 but save significantly more by preventing fraudulent transactions. The digital wallet app development cost increases substantially with comprehensive security, but it’s essential for user trust and regulatory compliance.

Read Also: Python vs JavaScript: Which Is Better for Web Development

| Security Feature | Implementation | Cost Range |

| End-to-End Encryption | SSL/TLS, AES-256 | $8,000 – $18,000 |

| Two-Factor Authentication | SMS, Email, Authenticator | $4,000 – $10,000 |

| Tokenization | Payment data protection | $6,000 – $15,000 |

| PCI-DSS Compliance | Audit, implementation, certification | $15,000 – $40,000 |

| Fraud Detection | ML-based monitoring | $20,000 – $50,000 |

| Biometric Authentication | Face ID, Touch ID, fingerprint | $5,000 – $12,000 |

| Security Audits | Penetration testing, vulnerability assessment | $5,000 – $15,000 |

Factor 8: Development Team Structure

Team composition dramatically affects your app development cost. An in-house team provides maximum control but requires significant investment in salaries, benefits, infrastructure, and management.

Hiring an app development company offers comprehensive services from design to deployment. Agencies charge $50-$250 per hour depending on location and expertise, with project-based pricing providing cost predictability.

Freelancers offer the lowest hourly rates ($25-$100) but may lack the full skill set or reliability for complex projects. Staff augmentation combines in-house and external resources, offering flexibility.

| Team Type | Pros | Cons | Cost Range |

| In-House Team | Full control, dedicated resources | High overhead, long hiring process | $200,000 – $500,000+ annually |

| Development Agency | Complete services, experienced teams | Less control, communication gaps | $50,000 – $300,000 per project |

| Freelancers | Flexible, cost-effective | Quality risks, limited availability | $30,000 – $100,000 per project |

| Staff Augmentation | Scalable, specific expertise | Management overhead | $40,000 – $200,000 per project |

Factor 9: Developer Location

Geographic location is one of the biggest cost differentiators. North American developers charge premium rates ($100-$250/hour) but offer proximity, cultural alignment, and strong legal frameworks.

European developers ($80-$180/hour) provide excellent quality with good English proficiency. Eastern European countries like Poland and Romania offer the best value-to-quality ratio at $40-$80/hour.

Asian markets, particularly India, Vietnam, and the Philippines, offer the lowest rates ($25-$60/hour) with large talent pools. However, time zone differences and communication challenges require careful management.

Latin American developers ($30-$70/hour) provide a middle ground with overlapping US time zones and cultural similarities. The mobile wallet app development cost can vary by 300-400% based solely on location choice.

| Region | Average Hourly Rate | Basic App | Mid-Level App | Advanced App |

| United States | $150 – $250 | $120,000 – $150,000 | $150,000 – $250,000 | $250,000 – $500,000 |

| Canada | $100 – $180 | $90,000 – $130,000 | $130,000 – $220,000 | $220,000 – $400,000 |

| UK | $90 – $180 | $85,000 – $125,000 | $125,000 – $210,000 | $210,000 – $380,000 |

| Western Europe | $80 – $150 | $75,000 – $110,000 | $110,000 – $190,000 | $190,000 – $350,000 |

| Eastern Europe | $40 – $80 | $40,000 – $70,000 | $70,000 – $130,000 | $130,000 – $220,000 |

| India | $25 – $50 | $30,000 – $50,000 | $50,000 – $100,000 | $100,000 – $180,000 |

| Southeast Asia | $30 – $60 | $35,000 – $55,000 | $55,000 – $110,000 | $110,000 – $190,000 |

| Latin America | $35 – $70 | $38,000 – $65,000 | $65,000 – $120,000 | $120,000 – $210,000 |

E-Wallet App Development Cost by Development Stages

Breaking down costs by development phases helps you plan cash flow and milestones effectively. Each stage has specific deliverables and investment requirements.

Phase-wise Cost Breakdown

| Development Stage | Activities | Duration | Cost (% of Total) | Cost Range |

| Discovery & Planning | Market research, requirements gathering, feasibility study, project roadmap | 2-4 weeks | 10-15% | $5,000 – $20,000 |

| Design & Prototyping | Wireframes, UI/UX design, interactive prototypes, design system | 4-8 weeks | 15-20% | $10,000 – $40,000 |

| Development & Coding | Frontend, backend, API development, database setup, integrations | 12-24 weeks | 40-50% | $30,000 – $150,000 |

| Testing & QA | Functional testing, security testing, performance testing, bug fixes | 4-6 weeks | 15-20% | $8,000 – $35,000 |

| Deployment | App store submission, server setup, final configurations | 1-2 weeks | 5-8% | $3,000 – $15,000 |

| Post-Launch Maintenance | Bug fixes, updates, performance monitoring, feature additions | Ongoing | 15-20% annually | $10,000 – $60,000/year |

The discovery and planning phase lay the foundation with market analysis, competitor research, and technical architecture planning. This stage costs 10-15% of the total budget but prevents expensive mistakes later.

Design and prototyping consume 15-20% of the budget, creating the visual blueprint and user flow. Professional designs significantly impact user adoption and retention rates.

Development and coding are the most expensive phase at 40-50% of total costs. This includes frontend, backend, database architecture, third-party integrations, and core functionality implementation.

Testing and QA ensure your app works flawlessly across devices and scenarios. Allocating 15-20% of budget here prevents costly post-launch issues and negative reviews.

Deployment involves app store submissions, server configuration, and final polish. This phase typically costs 5-8% of the budget but requires careful attention to approval guidelines.

Post-launch maintenance is an ongoing investment of 15-20% of initial development costs annually. This covers updates, security patches, new OS version compatibility, and feature enhancements.

Read Also: Web App Development Cost

Hidden Costs in E-Wallet App Development

Beyond development itself, several hidden costs catch startups off guard. How much does it cost to develop an eWallet app depends heavily on these often-overlooked expenses.

Regulatory compliance and licensing vary by country and region. Financial licenses in the US can cost $50,000-$200,000, while PSD2 compliance in Europe adds $30,000-$100,000.

Third-party integrations and APIs for KYC verification, SMS services, email services, and payment gateways cost $200-$2,000 monthly per service. Annual costs can reach $10,000-$40,000.

Server and hosting costs scale with user growth. Initial hosting costs $500-$2,000 monthly but can reach $10,000+ monthly for apps with millions of users.

App store publishing fees include $99 annually for Apple App Store and a one-time $25 fee for Google Play Store. However, both platforms take 15-30% commission on in-app transactions.

Ongoing maintenance and updates consume 15-20% of initial development costs annually. This includes bug fixes, OS updates, security patches, and new feature development.

Customer support infrastructure requires investment in helpdesk software, support staff, and training. Expect $3,000-$15,000 monthly depending on user base size.

Security audits and certifications are essential for financial apps. Annual security audits cost $5,000-$20,000, while PCI-DSS certification renewal adds $5,000-$15,000 yearly.

| Hidden Cost | Frequency | Cost Range |

| Regulatory Compliance & Licensing | One-time + Annual | $50,000 – $200,000 initial, $10,000 – $50,000/year |

| Third-party APIs | Monthly | $200 – $2,000/service/month |

| Server & Hosting | Monthly | $500 – $10,000+/month |

| App Store Fees | Annual + Commission | $99/year (Apple), $25 one-time (Google) + 15-30% commission |

| Maintenance & Updates | Annual | 15-20% of initial dev cost |

| Customer Support | Monthly | $3,000 – $15,000/month |

| Security Audits | Annual | $5,000 – $20,000/year |

| Legal & Insurance | Annual | $5,000 – $30,000/year |

| Marketing & User Acquisition | Monthly | $5,000 – $100,000+/month |

How to Reduce E-Wallet App Development Cost

Smart strategies can significantly reduce your investment without compromising quality. Starting with an MVP (Minimum Viable Product) is the most effective cost-reduction approach.

Launch with core features only user registration, basic payments, and transaction history. This reduces initial development costs by 40-60%, letting you validate the market before full investment.

Prioritize core features over nice-to-have additions. Advanced features like AI recommendations or blockchain integration can be added in later versions based on user feedback.

Choose cross-platform development with React Native or Flutter to save 30-40% compared to building separate native apps. Modern cross-platform tools deliver near-native performance.

Outsource to cost-effective regions like Eastern Europe or Asia without sacrificing quality. You can access expert developers at 50-70% lower rates than North American teams.

Use ready-made solutions and APIs for standard features like payment processing, KYC verification, and authentication. This saves months of development time and reduces costs by $20,000-$50,000.

Implement agile methodology with iterative development cycles. This allows course corrections early, preventing expensive late-stage changes and ensuring budget efficiency.

Plan for scalability from the start to avoid costly architecture redesigns later. Investing 15-20% extra initially in scalable infrastructure saves 200-300% in future refactoring costs.

| Cost Reduction Strategy | Potential Savings | Best For |

| Start with MVP | 40-60% initial reduction | Startups, market validation |

| Cross-platform Development | 30-40% savings | Multi-platform launch |

| Outsource to Asia/Eastern Europe | 50-70% on development | Budget-conscious projects |

| Use Ready-made APIs | $20,000 – $50,000 savings | Standard features |

| Agile Methodology | 15-25% on changes/rework | All projects |

| Cloud Infrastructure | 30-50% on hosting | Scalable applications |

| Template-based Design | $10,000 – $25,000 savings | MVP, tight budgets |

E-Wallet App Development Cost: Real-World Examples

Let’s examine realistic cost estimates for different e-wallet app scenarios to give you concrete budgeting references.

Basic E-Wallet App Cost Estimate

A basic digital wallet for a local market or specific use case includes essential features only. User registration, simple payment processing, transaction history, and basic security form the core.

Features included: Email/phone registration, password authentication, link bank account, send/receive money, transaction list, push notifications, basic customer support.

Platform: iOS or Android (single platform)

Development time: 3-4 months

Team location: Eastern Europe or Asia

Total cost: $40,000 – $60,000

This entry-level digital wallet development option works well for startups testing market fit or businesses adding payment functionality to existing services.

Mid-Level E-Wallet App Cost Estimate

A mid-level wallet targets broader markets with enhanced functionality and better user experience. It includes all basic features plus advanced payment options and improved security.

Features included: Social login, biometric authentication, QR code payments, NFC support, multi-currency, transaction filters, split payments, custom UI/UX design, in-app customer support.

Platform: iOS and Android (cross-platform)

Development time: 5-7 months

Team location: Eastern Europe or Latin America

Total cost: $90,000 – $130,000

This tier suits established businesses entering the fintech space or startups with secured funding ready for comprehensive market entry.

Advanced E-Wallet App Cost Estimate

Advanced wallets compete with major players offering cutting-edge features and sophisticated capabilities. They include everything in mid-level plus premium additions.

Features included: All mid-level features + AI fraud detection, machine learning recommendations, cryptocurrency support, loyalty programs, advanced analytics, IoT integration, investment features, bill payments, merchant integrations.

Platform: iOS, Android, and Web

Development time: 8-12 months

Team location: Mixed (design from US/Europe, development from Eastern Europe/Asia)

Total cost: $180,000 – $250,000

This level requires working with a specialized digital payment app development company that has proven expertise in complex fintech solutions.

Enterprise-Level E-Wallet App Cost Estimate

Enterprise solutions serve financial institutions, large corporations, or white-label platforms requiring maximum customization and compliance.

Features included: Everything in advanced tier + custom infrastructure, complete regulatory compliance suite, white-label capabilities, advanced security certifications, dedicated support systems, custom integrations with legacy systems, multi-country support, advanced reporting and analytics.

Platform: iOS, Android, Web, and Admin Panel

Development time: 12-18 months

Team location: Premium agencies with proven enterprise experience

Total cost: $300,000 – $600,000+

Enterprise projects demand custom eWallet app development services with extensive experience in enterprise-scale deployments and regulatory compliance.

| App Type | Key Features | Timeline | Total Cost |

| Basic E-Wallet | Registration, basic payments, history, simple security | 3-4 months | $40,000 – $60,000 |

| Mid-Level E-Wallet | Basic + QR/NFC, biometric, multi-currency, custom design | 5-7 months | $90,000 – $130,000 |

| Advanced E-Wallet | Mid-level + AI/ML, crypto, loyalty, analytics, IoT | 8-12 months | $180,000 – $250,000 |

| Enterprise E-Wallet | Advanced + white-label, full compliance, custom infrastructure | 12-18 months | $300,000 – $600,000+ |

Challenges in E-Wallet App Development

Building a successful e-wallet involves overcoming several significant challenges that impact both development costs and time to market.

- Regulatory compliance tops the challenge list. Financial regulations vary dramatically across countries and states. PCI-DSS, GDPR, PSD2, and local banking laws require extensive documentation and implementation.

- Security concerns demand constant vigilance. E-wallets are prime targets for hackers, requiring multiple security layers, regular audits, and rapid response to emerging threats.

- User trust and adoption prove difficult in saturated markets. Users worry about security, privacy, and reliability. Building trust requires flawless functionality, transparent policies, and strong customer support.

- Technical complexity increases with advanced features. Real-time transaction processing, multi-currency exchange, blockchain integration, and AI fraud detection require specialized expertise.

- Integration with existing systems challenges enterprise deployments. Legacy banking systems, payment processors, and third-party services often use outdated protocols requiring custom adapters.

How AleaIT Solutions Can Help You Build a Successful Digital Wallet App

AleaIT Solutions brings deep fintech expertise and proven experience in eWallet app development services to help you launch a secure, scalable, and future-ready digital payment platform.

Our highly skilled developers, UI/UX designers, and fintech experts work together to deliver innovative solutions tailored to your business goals.

Whether you’re a startup looking to build your first MVP or an enterprise aiming for full-scale deployment, our end-to-end approach ensures your e-wallet app meets the highest industry standards.

As a leading wallet app development company, we understand that every business has unique requirements. That’s why we offer fully customized solutions aligned with your budget, timeline, and growth strategy.

Our transparent pricing, agile methodology, and commitment to quality ensure you get maximum value from your investment.

Conclusion

Understanding e-wallet app development cost is essential for successful project planning and execution. Partnering with an experienced on demand app development company can help you build smarter and scale faster.

As we’ve explored, costs range from $40,000 for basic apps to over $500,000 for enterprise solutions.

Multiple factors influence pricing — app complexity, platform choice, features, security requirements, team structure, and developer location all play crucial roles. The mobile wallet app development cost varies significantly based on these decisions.

Start with a clear vision of your target users and essential features. Build an MVP first, validate the market, then expand based on user feedback. This approach minimizes risk while maximizing learning.

Partnering with the right team is crucial. Hire eWallet app developers who combine fintech experience, strong technical skills, and transparent communication to deliver secure and scalable payment solutions.

Frequently Asked Questions (FAQs)

1. How Much Does it Cost to Develop an eWallet App?

The cost of developing an eWallet app typically ranges from $40,000 to $150,000+, depending on the app’s complexity, features, security requirements, and the development team’s location. A basic MVP costs less, while advanced apps with AI, blockchain, or multi-currency support cost more.

2. How long does it take to develop a digital wallet app?

On average, it takes 3 to 9 months to build a digital wallet app. A simple MVP may be ready in 10–14 weeks, while a fully featured app like Google Pay can take over 9 months due to complex integrations, compliance, and rigorous testing.

3. What factors determine the eWallet app cost?

Key factors influencing the cost include:

- Features & Functionality (KYC, QR payments, P2P transfers, bill payments)

- Technology Stack & Security (encryption, fraud prevention, PCI DSS compliance)

- UI/UX Design Complexity

- Third-Party Integrations (payment gateways, banks, APIs)

- Platform Choice (iOS, Android, cross-platform)

- Team Location & Expertise

4. Is it expensive to build a payment wallet like Paytm or Google Pay?

Yes, building a payment wallet like Paytm, Google Pay, or PhonePe requires a substantial investment. These apps need banking partnerships, advanced security, AI-driven fraud detection, cloud scalability, and compliance with strict financial regulations. Development costs can easily exceed $200,000+.

5. How to reduce eWallet app development cost?

Businesses can reduce costs by:

- Starting with an MVP (core features only)

- Using cross-platform frameworks (Flutter, React Native)

- Leveraging ready-made payment APIs & SDKs

- Outsourcing development to cost-effective regions

- Planning features in phases rather than all at once

6. What features should an eWallet app include?

Essential features include user registration, KYC verification, secure login, bank account linking, QR code scanning, peer-to-peer transfers, bill payments, transaction history, push notifications, and customer support. Advanced features may include loyalty rewards, AI-based spending insights, and crypto wallet integration.

7. Are eWallet apps secure?

Yes, but only if they are developed with robust security protocols like end-to-end encryption, tokenization, biometric authentication, PCI DSS compliance, and AI-based fraud detection. Security is one of the costliest but most crucial parts of digital wallet development.

8. Can an eWallet app support international transactions?

Absolutely. By integrating multi-currency support, forex APIs, and compliance with global regulations, an eWallet app can handle cross-border payments. However, this adds complexity and increases development costs.

9. Who needs an eWallet app?

EWallet apps are widely used by banks, fintech startups, eCommerce businesses, ride-hailing companies, food delivery platforms, and retail chains to simplify payments, improve customer retention, and provide secure digital transactions.

10. How do eWallet apps make money?

Common revenue models include:

- Transaction fees from merchants

- Commission on bill payments & recharges

- Premium features or subscriptions

- Partnerships with banks & retailers

- In-app ads and loyalty programs